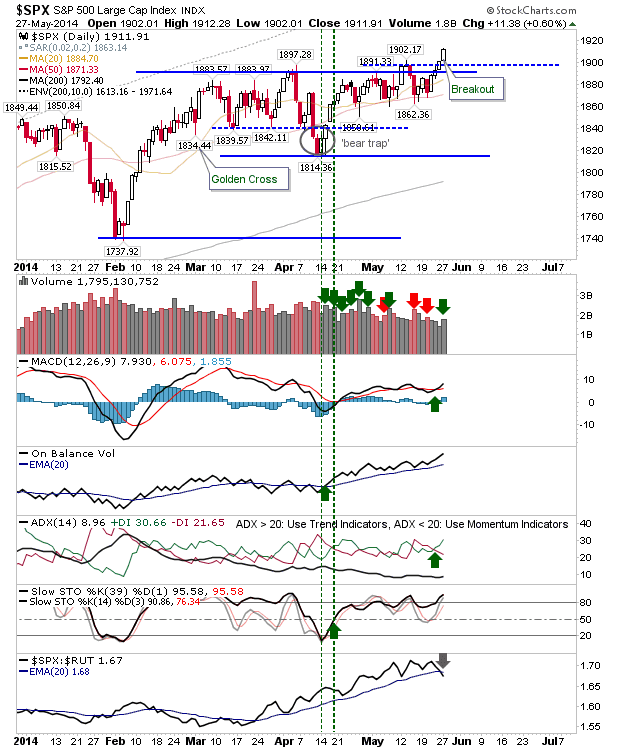

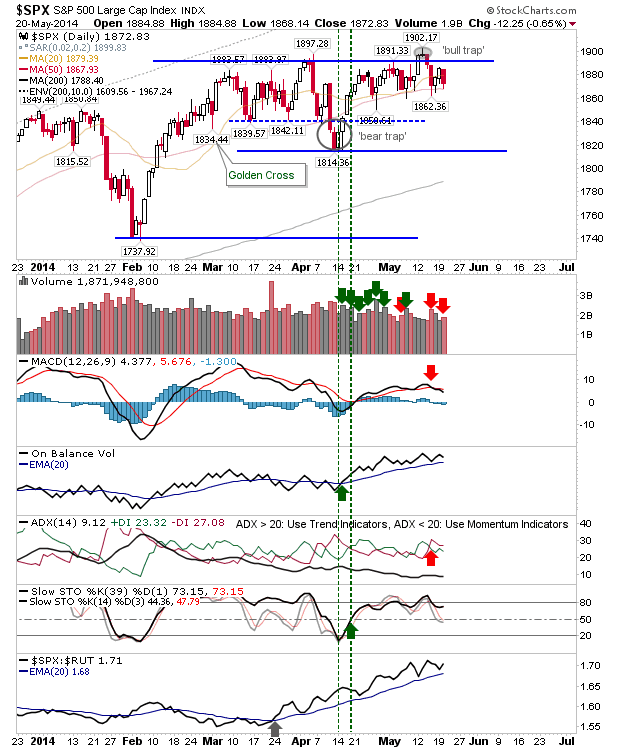

No surprises to see after four days of gains that markets gave up a little ground. The S&P is comfortably holding its breakout. Today's selling came on lighter volume with no discernible technical weakness. The Nasdaq didn't quite get to resistance, but today's action will count as good as a test of said resistance. Likewise, technicals held up well in the face of this selling. The Russell 2000 held on to its 50-day MA, despite the large gap higher yesterday. A gap fill is distinctly possible over the next few days, but if it doesn't fill (i.e. it breaks above 1,144 before back filling) it will effectively confirm May as a significant swing low. Thursday will probably bring more of the same. As long as bulls can keep action in the top half of action defined by the last four days of trading, it will likely mean a prosperous summer ahead - despite seasonal factors. Now is an important time for firming up the May swing low. --- All Contributions We...