Daily Market Commentary: And The Bull-Bear Dance Continues

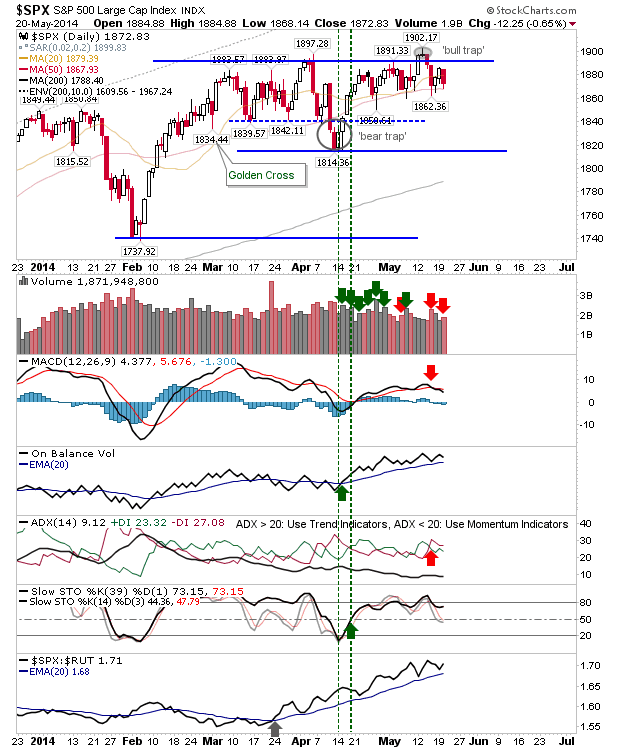

Across indices, bears posted a loss to counter yesterday's gain. It didn't change the broader picture, with trading ranges established in all lead indices.

The S&P held support at the 50-day MA on higher volume distribution; the second distribution in four days, with no accumulation days for the last of couple of weeks.

The Nasdaq also registered a distribution day, but is also stuck in no-mans land between 200-day and 50-day MA. Unlike the S&P it has suffered a sequence of distribution days. Technicals are on the bear side, although the MACD is still on a 'buy' signal.

The Russell 2000 found itself repelled by the 20-day MA with an upcoming 'Death Cross' between 20-day and 200-day MAs. This will further pressure the swing low support defined from February's low. Tomorrow could be the day this breaks.

The Dow was the hardest hit of today's indices, slicing through its 50-day MA with relative ease. It is hanging on to the recent swing lows, although a test of April's low looks favored.

Tomorrow is set up for bears. The Dow and Russell 2000 looks most likely to satisfy bears.

----

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The S&P held support at the 50-day MA on higher volume distribution; the second distribution in four days, with no accumulation days for the last of couple of weeks.

The Nasdaq also registered a distribution day, but is also stuck in no-mans land between 200-day and 50-day MA. Unlike the S&P it has suffered a sequence of distribution days. Technicals are on the bear side, although the MACD is still on a 'buy' signal.

The Russell 2000 found itself repelled by the 20-day MA with an upcoming 'Death Cross' between 20-day and 200-day MAs. This will further pressure the swing low support defined from February's low. Tomorrow could be the day this breaks.

The Dow was the hardest hit of today's indices, slicing through its 50-day MA with relative ease. It is hanging on to the recent swing lows, although a test of April's low looks favored.

Tomorrow is set up for bears. The Dow and Russell 2000 looks most likely to satisfy bears.

----

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!