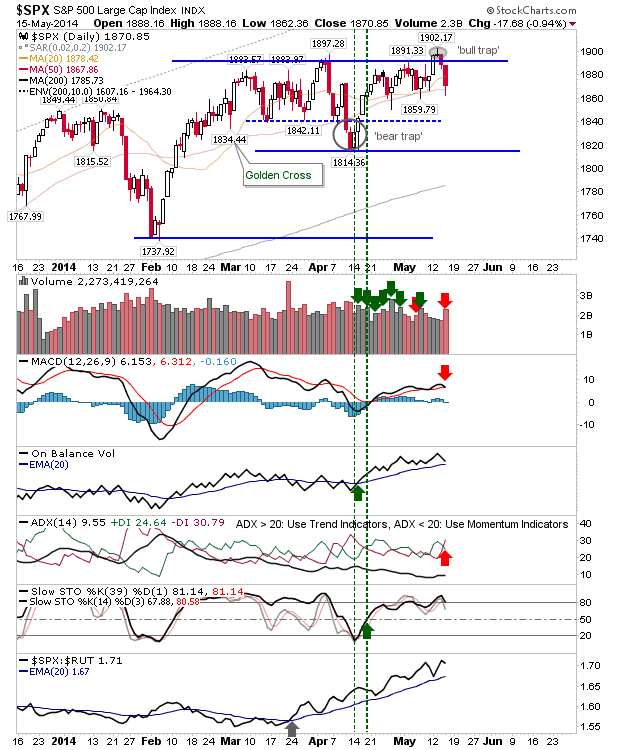

Daily Market Commentary: Bullish Follow Through

Friday's late afternoon buying got some upside follow through on Monday without challenging resistance. There is a chance of further upside until it gets to such resistance. The Nasdaq will soon be meeting converged 50-day MA and consolidation resistance, but it's a relative gain to the S&P will help attract new buyers. It remains to be seen if it can get through this barrier, but recent action is working in its favour (more so than the S&P).