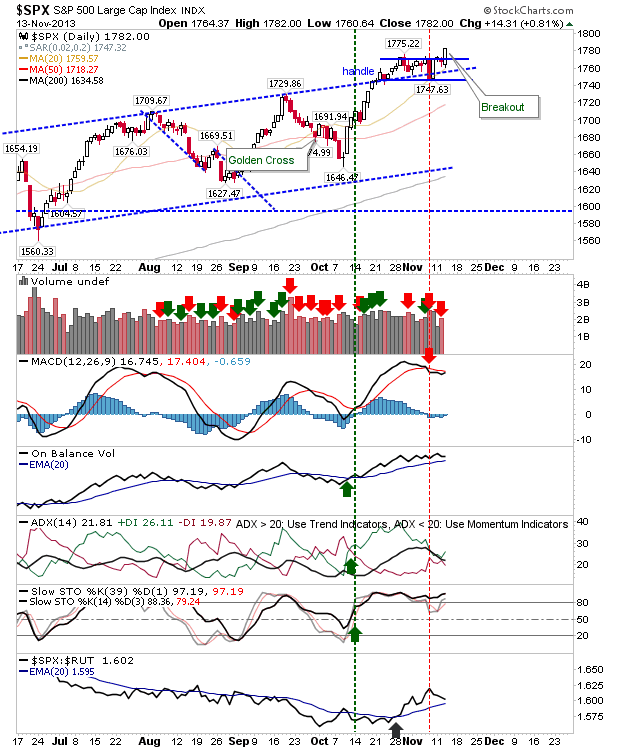

Daily Market Commentary: Drip Losses

Shorts will have been happy with today's action; small losses, an attempt to rally in the morning cut short, and late afternoon selling suggesting 'those in the know' were playing the side of the market they wanted to be. None of this changed much on the grander picture, which means bears may can sneak another few days like Wednesday under the radar before the retail market takes notice. The Semiconductor index was again the one where bears were finding it hard to remain orderly in the move to the exits. An undercut of the 50-day MA was a little too easy, although 0.5%+ gain today would see this important support level regained. The index looks on course to turn technically net bearish over the next few days, which would be reasonable expectation for further declines.