Daily Market Commentary: Roll Friday into Tuesday - Little to add for today

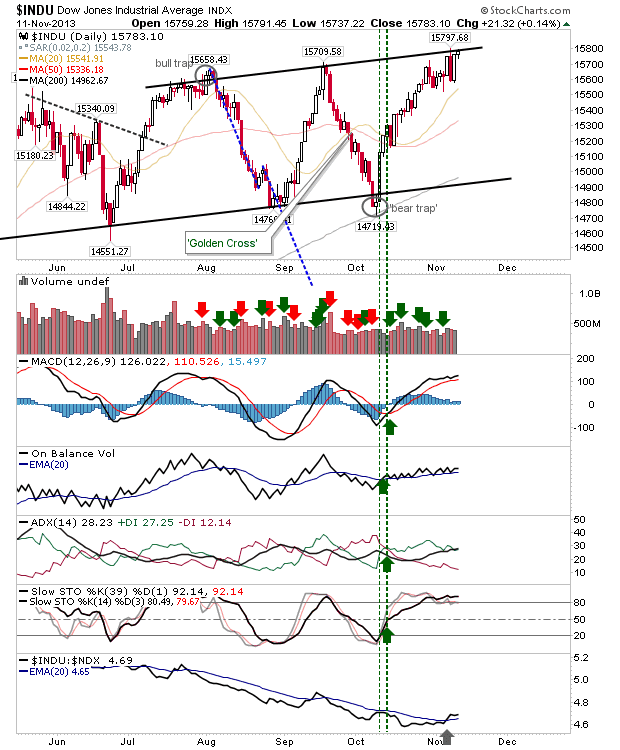

Out of today's action - the Dow might give shorts something to work with on Tuesday. The Veteran's day holiday was unlikely to generate a follow through day from Friday, but did well not to give back gains, which often happens in the absence of active buyers - irrespective of selling action. This makes any short position a considerable risk, but at least at today's close the risk of such short plays is low.