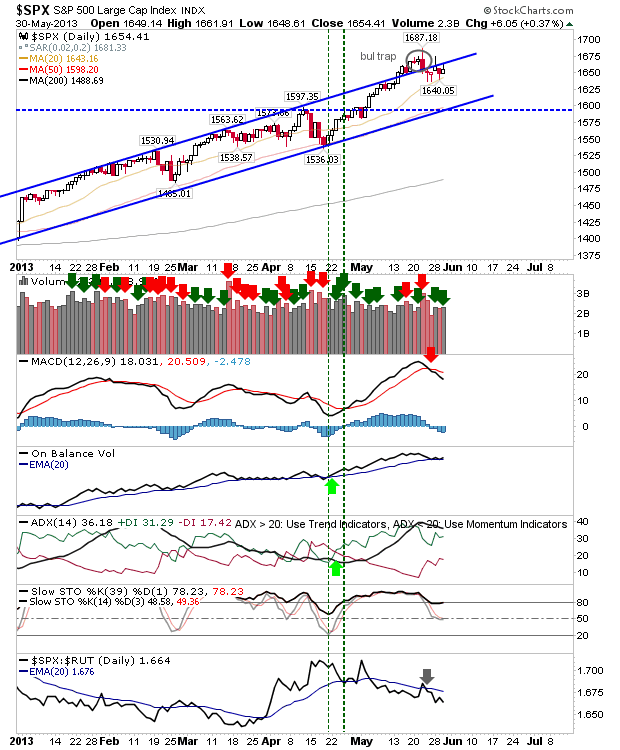

Daily Market Commentary: S&P 'Bull Trap' Intact

Despite missing a couple of days of action, the 'Bull Trap' which emerged in the S&P last week was still in play by today's close. The two attempts at a rally in the past few days were rebuffed by the close: 1,687 is looking increasingly like a swing high top, and a good place to measure risk:reward if looking to go short. The MACD has already triggered a 'sell'.