Weekly Market Commentary: Rally Expands

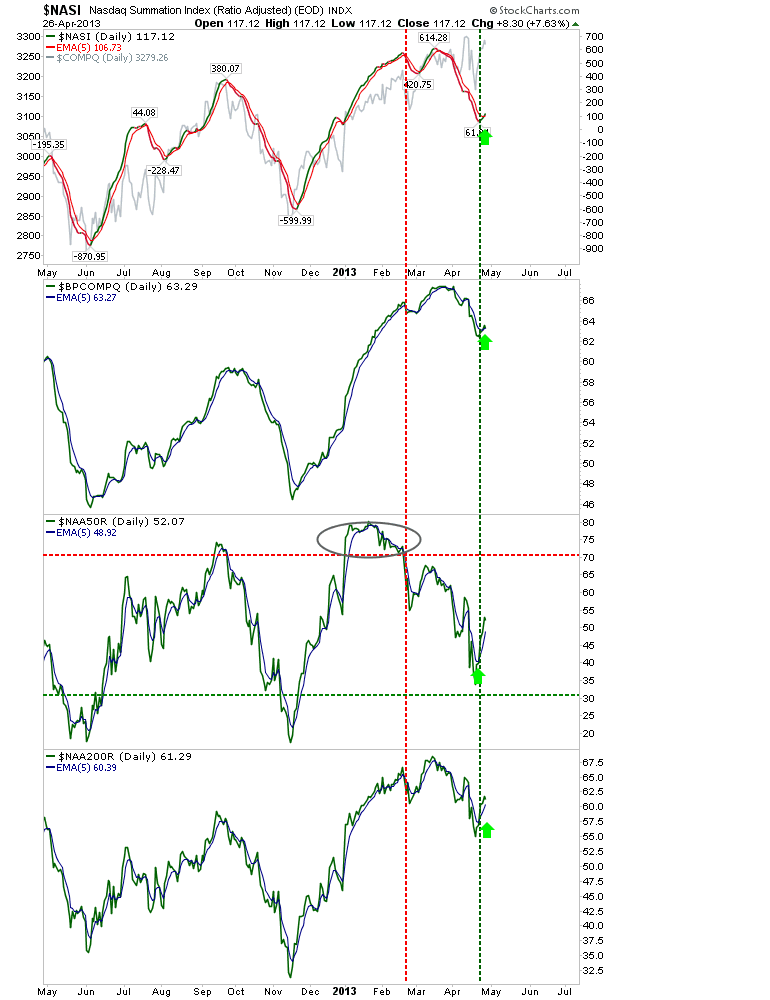

Market Breadth accelerated higher, firming up the swing low and supporting the current leg of the rally. The swing low emerged from relative strength - not from an oversold state - as is typical at major lows. So while the Percentage of Nasdaq Stocks above the 50-day MA has room to run before it becomes overbought, the Nasdaq Bullish Percents and Nasdaq Summation Index will be soon be in overbought territory once more.