Daily Market Commentary: Rally Intact

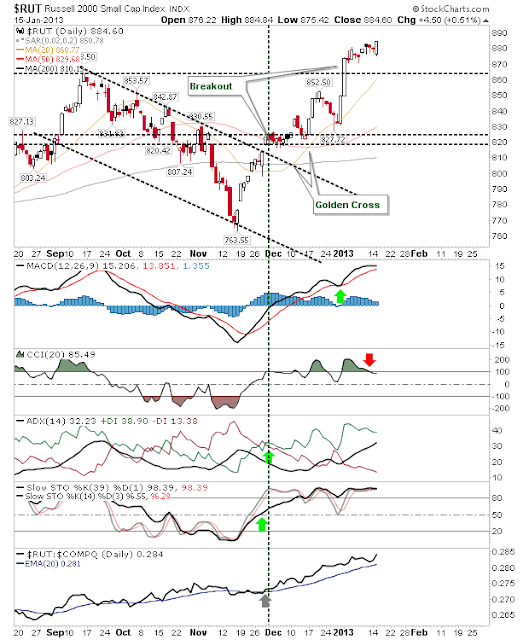

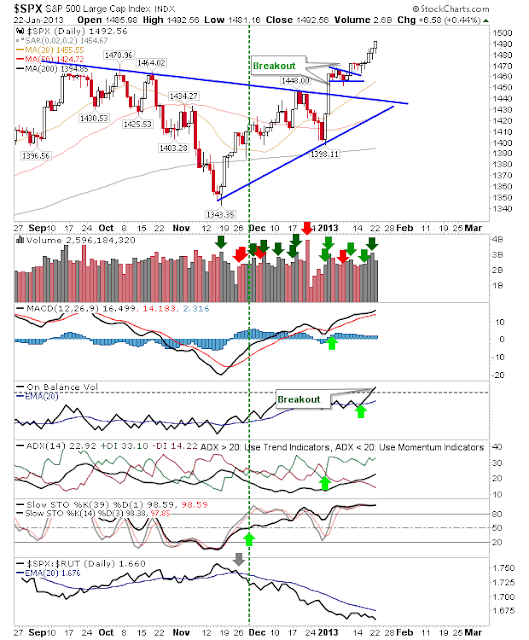

The long weekend didn't sate bulls appetite for shares and markets continued their advance higher, albeit on lower volume. Despite the lower volume, there was a resistance breakout for On-Balance-Volume in the S&P. This should maintain support for the rally. The Nasdaq maintained its consolidation breakout, but it needs a solid gain to put some distance from the consolidation. The Russell 2000 has no such concerns. Today's gain maintained a run generated by the push above September's swing high. Technicals are running in overbought territory, with the index 10% above its 200-day MA. This is a good time for selling covered calls on existing holdings, with a reversion to mean likely to happen soon. In the short term, a cooling off period can be expected in the Russell 2000, but this might provide an opportunity for Tech and Large Cap indices to attract buyers and take up some of the running. --- Follow Me on Twitter Dr. Declan Fallon is the Seni