Daily Market Commentary: Stalled Advance

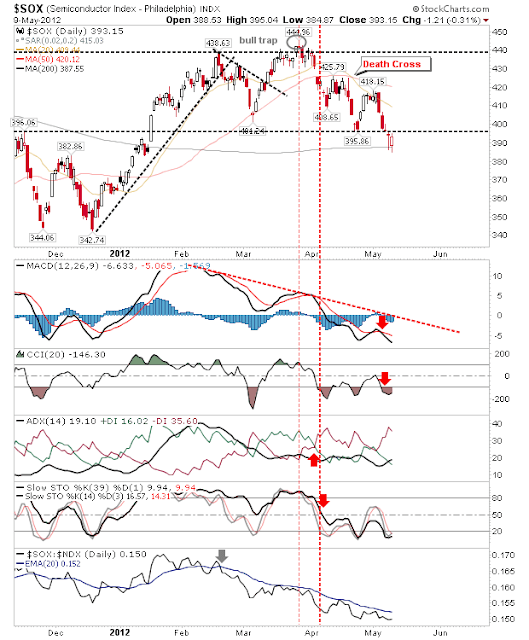

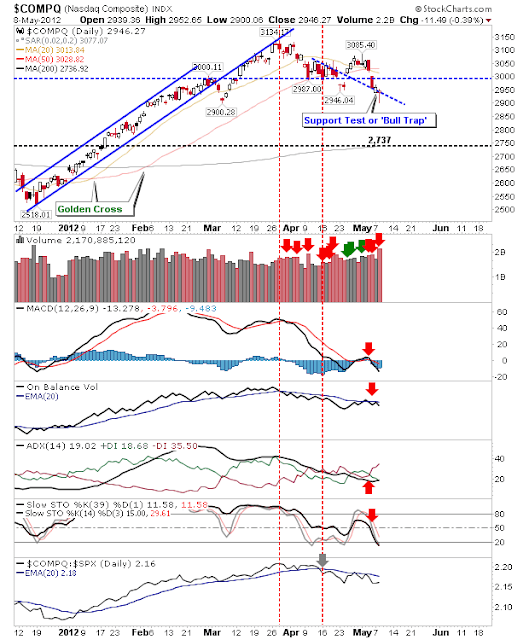

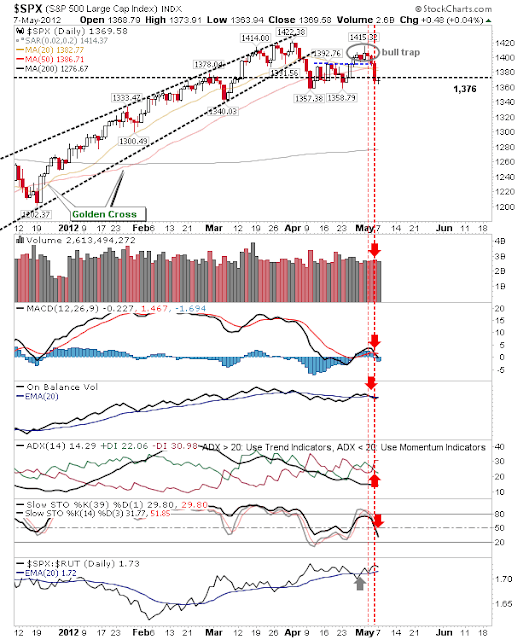

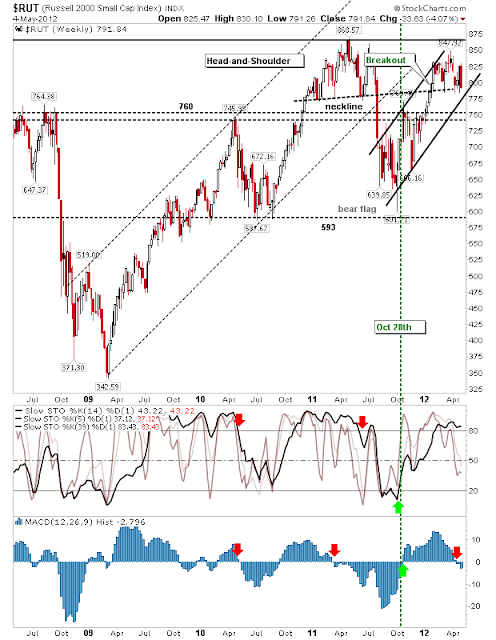

There was a bullish setup on Wednesday's close for the likes of the Russell 2000 and Semiconductor index, but after a bullish start markets drifted lower by the close. The S&P finished with an inside day which in itself is bullish; stops on a loss of yesterday's low. The Nasdaq started with a gap higher, but it couldn't push the advantage and technicals failed to improve. It was the same story for the semiconductor index, but until it breaks yesterday's low it remains 'long' favoured. It was the same story for the Russell 2000 with yesterday's low the stop for a long position. It's looking like a case of rinse and repeat for Friday. Today wasn't great, but it didn't change anything either. Semiconductors and Russell 2000 are best placed for potential buyers. --- Follow Me on Twitter Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com . I offer a range of stock trading stra...