Daily Market Commentary: Further Selling

Selling continued for a sixth day but it didn't violate the support which has been in play for the past couple of days.

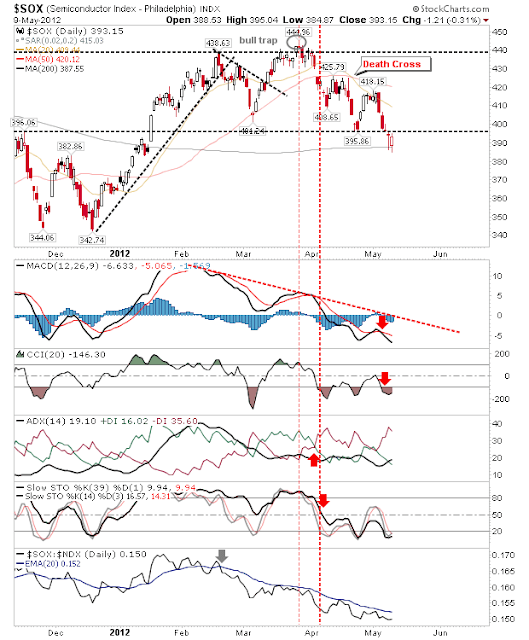

The semiconductor index opened at its 200-day MA and was able to rally back to yesterday's close. Technicals are still in the bear camp but buyers may be willing to overlook this in favour of 200-day MA support.

The Nasdaq finished lower but in the process clambered back to declining support as it attempts to create a swing low. The index finished with an inside day which keeps Tuesday's low in play for stop placement.

The Russell 2000 was able to retain wedge support despite finishing slightly lower. Technicals returned to a net bearish state but in doing so also moved into oversold territory. But working in bulls favour is the continued shift to Small Caps over Tech stocks.

The S&P was caught in the middle, working in the absence of clear support with a 'Death Cross' between 20-day and 50-day MAs to stoke bulls' fears.

Tomorrow's story is an extension of yesterday's; trading support for the likes of the semiconductor index and Russell 2000 perhaps offers the best short term opportunity.

-----

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The semiconductor index opened at its 200-day MA and was able to rally back to yesterday's close. Technicals are still in the bear camp but buyers may be willing to overlook this in favour of 200-day MA support.

The Nasdaq finished lower but in the process clambered back to declining support as it attempts to create a swing low. The index finished with an inside day which keeps Tuesday's low in play for stop placement.

The Russell 2000 was able to retain wedge support despite finishing slightly lower. Technicals returned to a net bearish state but in doing so also moved into oversold territory. But working in bulls favour is the continued shift to Small Caps over Tech stocks.

The S&P was caught in the middle, working in the absence of clear support with a 'Death Cross' between 20-day and 50-day MAs to stoke bulls' fears.

Tomorrow's story is an extension of yesterday's; trading support for the likes of the semiconductor index and Russell 2000 perhaps offers the best short term opportunity.

-----

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!