Daily Market Commentary: Small Caps Take The Heat

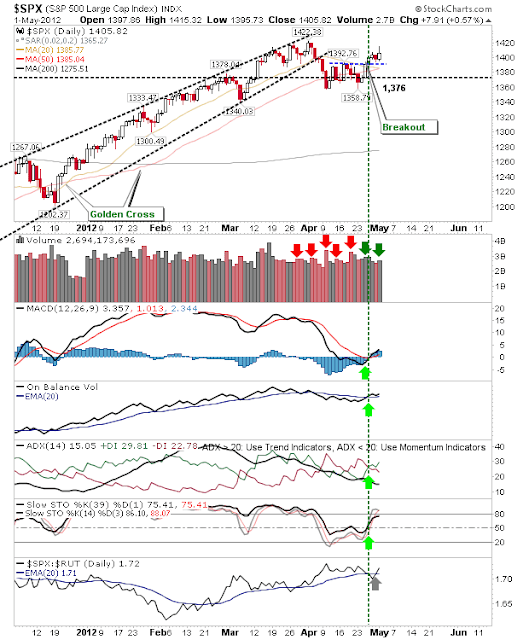

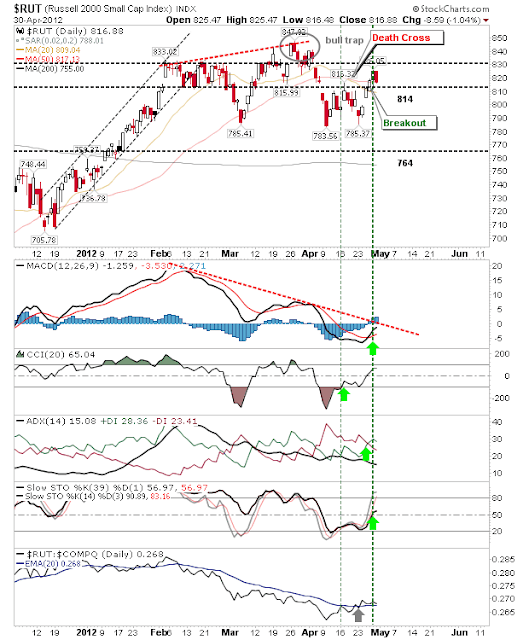

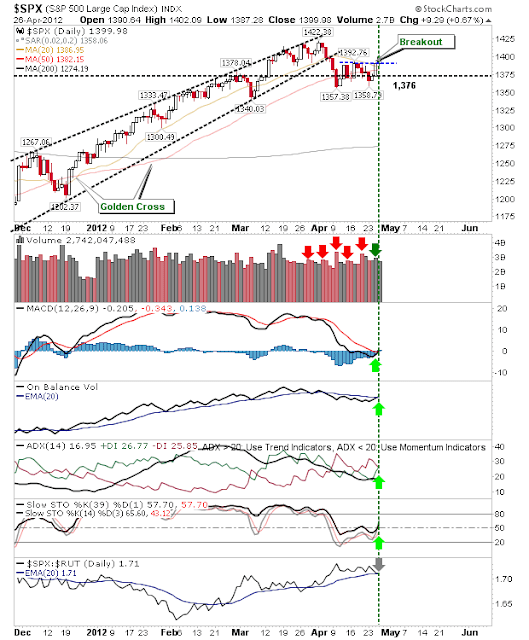

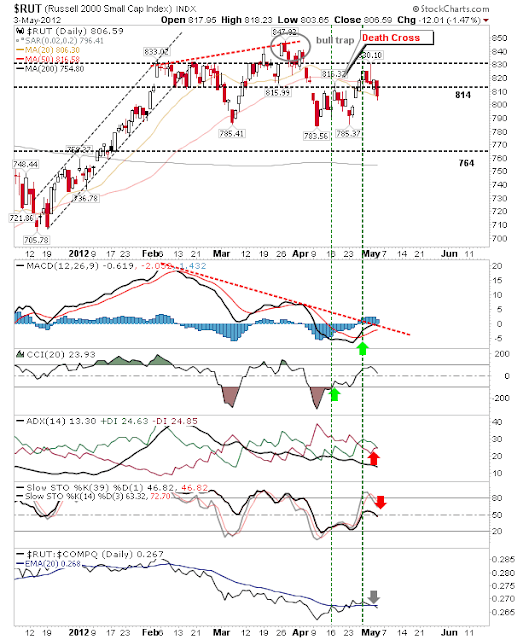

The Selling was mixed, but it was Small Caps which took the brunt of the selling. In the Russell 2000 there was a loss of 814 support, but it was able to dig its heel in at the 20-day MA. But it's getting more sketchy for longs. The index is looking to resume its under-performance against Tech and Large Caps, which is really bearish all round... The S&P was able to hang on to its breakout, leaning on the 50-day MA for support. There is an opportunity for longs to take advantage of 50-day MA support in the Nasdaq, although it could be a slippy slope if the index was to take a loss tomorrow. For tomorrow it will be a case of bulls digging in at the open, but if after an hour there is no sign of buyers it could turn into a very long day. ---- Follow Me on Twitter Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com . I offer a range of stock trading strategies for global markets which can be Previewed for Free with d