Daily Market Commentary: Stop the Rot?

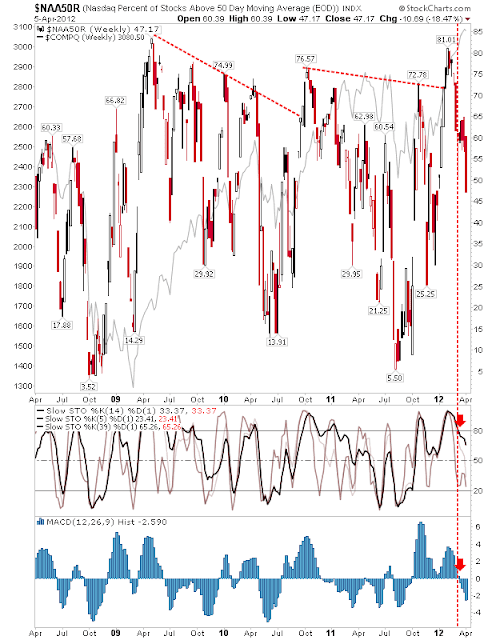

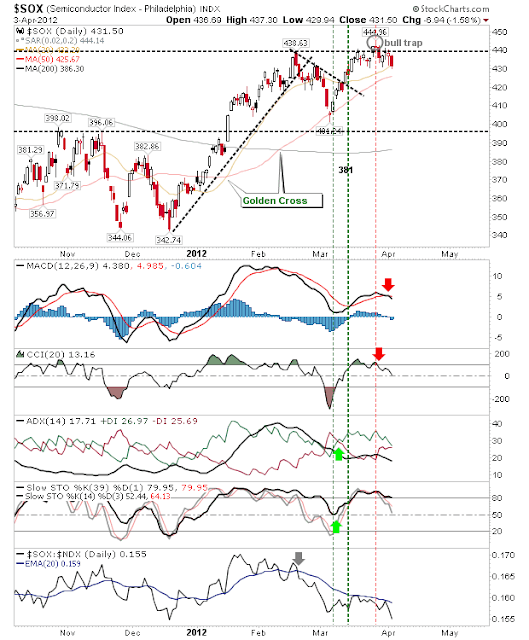

Yesterday's action was the first sign of concerted selling for the December-April rally, which meant today was little more than a breather. Whether bulls step in to build a swing low remains to be seen, but market breadth does offer scope for opportunity. The Nasdaq Bullish Percents are in overbought territory, but technicals are approaching (or have indeed exceeded) the swing lows defined by the December bottom. The Percentage of Nasdaq Stocks above the 50-day MA has reached a swing low and technicals look to support this. While the Nasdaq Summation Index is caught in the middle; technicals are oversold but the parent breadth measure is closer to overbought than oversold. If breadth indicators are marking a low, it's a swing low of a larger rally. The presence of the 50-day MA offers another reason to be a buyer. What may hold the Nasdaq back is the semiconductor index; it's trading well below its 50-day MA. The Russell 2000 is also keeping ...