Indices took their loses but the real hit was to market breadth.

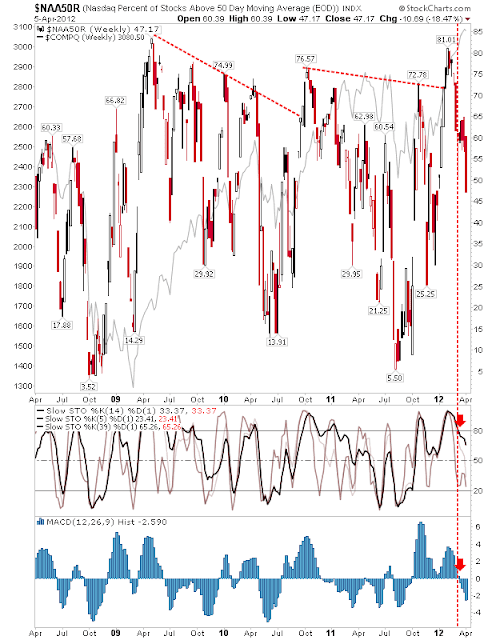

The Percentage of Nasdaq Stocks above the 50-day MA dropped sharply from 60% to 47%. The potential swing low was knocked out, although it could be a couple of weeks before the impacts on the parent Nasdaq are felt (as was the case in early 2011).

However, the Nasdaq Bullish Percents held gains despite the losses in the Percentage of Nasdaq Stocks above the 50-day MA. It still looks like an extended swing high, but until proven otherwise it's supporting the rally.

The Nasdaq Summation Index joined the Percentage of Nasdaq Stocks above 50-day MA in feeling the pain. Technicals turned net bearish as the breadth indicator returned to breakout support.

The immediate impact of breadth weakness on the Nasdaq was small. The index continued to hug ascending resistance from the broadening wedge. The index did finish the week lower, but volume was very light. Further downside looks more likely, particularly with increasing weakness in Nasdaq breadth.

As for other indices, the Russell 2000 continued to struggle to break 830 resistance. The weaker close hurt, but not enough to trigger a selling rout. The index did finish the week near its low and a move back to the former head-and-shoulder neckline (from early 2011) looks a more probable outcome.

While the S&P rebounded off 1,426 resistance.

While it may take a number of weeks for breadth loses to impact, it's looking more likely markets will have a range bound summer.

---

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com. I offer a range of stock

trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the

Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental

stock alerts,

stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed

stock quote watchlists, multi-currency

portfolio manager, active

stock screener with fundamental trading strategy support and

trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!