Weekly Market Commentary: Losses Haven't Broken Trend Yet...

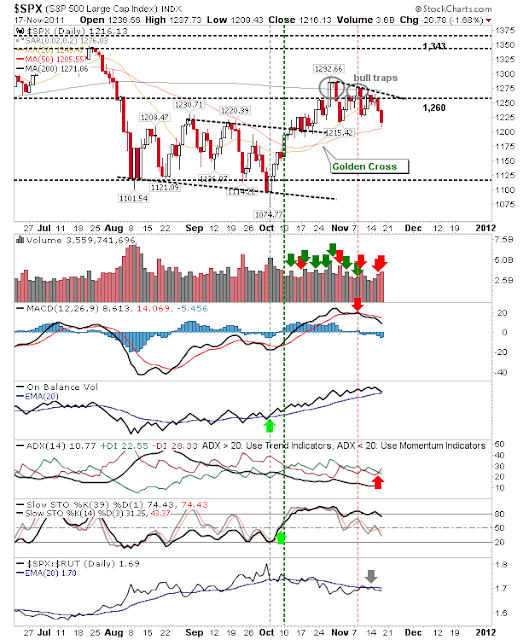

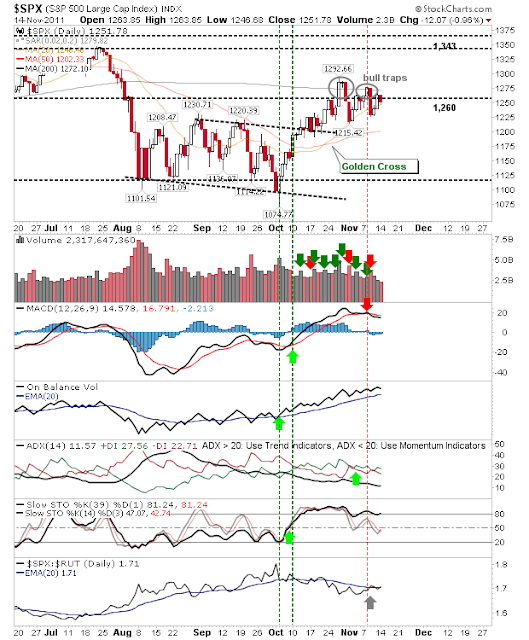

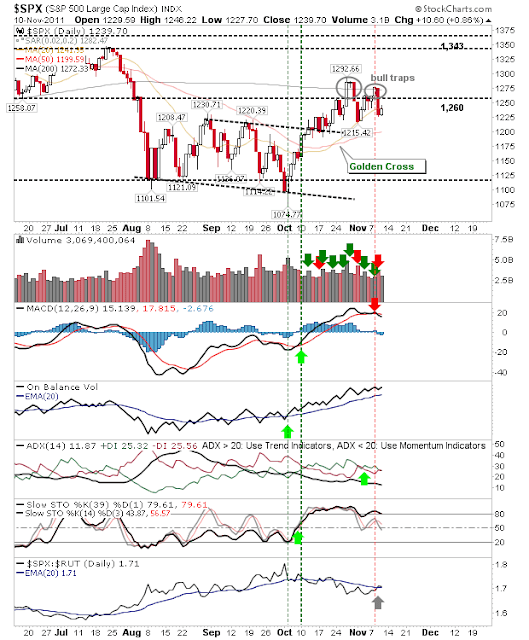

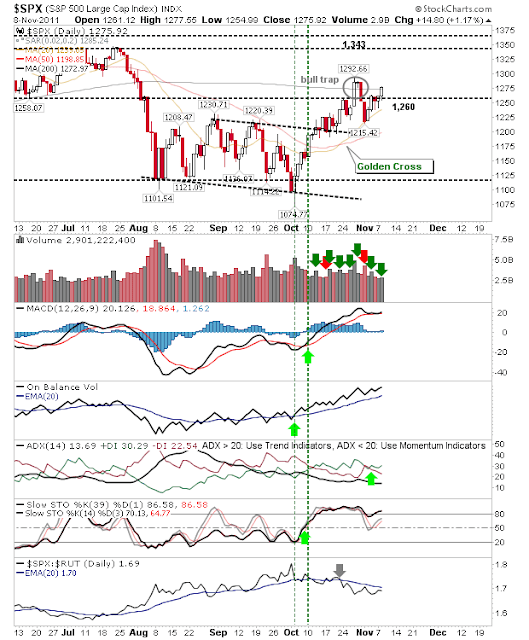

Last week's damage on the daily time frame didn't change too much on the weekly one. The Dow was the only index to show a change on the week; losses left a new 'bull trap'. Stochastics didn't make it to overbought levels prior to the 'bull trap' developing. Optimists will see this as offering room for further gains. Pessimists will see this as the start of a bear market top. The 'bull trap' in the Dow was not repeated in the S&P. Support at 1,209 remains in play and bulls have a good opportunity to mount a defense next week. The Russell 2000 confirmed resistance at 760 but the weekly loss didn't take it below rising channel support. The shortened week and the traditional 'Black Friday' rally will likely see such support hold for another week. Just to complete the set, the Nasdaq finished on channel support. Will bulls be able to take advantage? Monday will be a good place to start. ------ Follow Me on Twitter