Weekly Review of Stockcharts.com Publishers' Charts

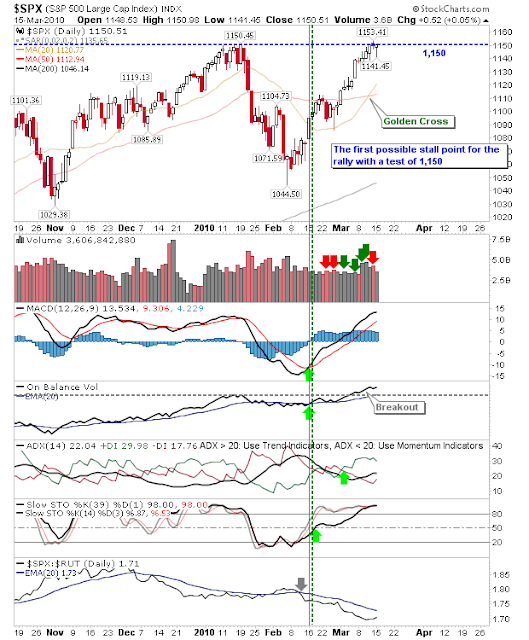

Friday's selling will have given the bears something to cheer but the back hasn't been broken for this rally. Anthony Caldaro of Objectiveelliotwave.com tracks pivot prices for the S&P with wave 3 up in play; rally intact with wave 3 targets of 1,219 and 1,326. Yong Pan of Cobrasmarketview maintains neutral rankings on the short term and mixed sentiment on the intermediate time frame Watch for black candlestick (strong gap open) for Monday; note all 'short sell' trigger Inverse CPCE peaked Same setup for the QQQQs Richard Lehman of Trendchannelmagic.com is watching broader February channels within which are mini-channels which broke for market leading small caps and Tech. 3/21 -- Friday's minor dip simply took the Dow to its lower blue minichannel line, where it promptly bounced before the close. The SPX did roughly the same, but the Naz, RUT, and tech stocks penetrated their blue minis and are heading toward their green channel lines. ...