Weekly Market Commentary: Rally On Course to Test 2008 Reaction Highs (Tech) or Lows (S&P)

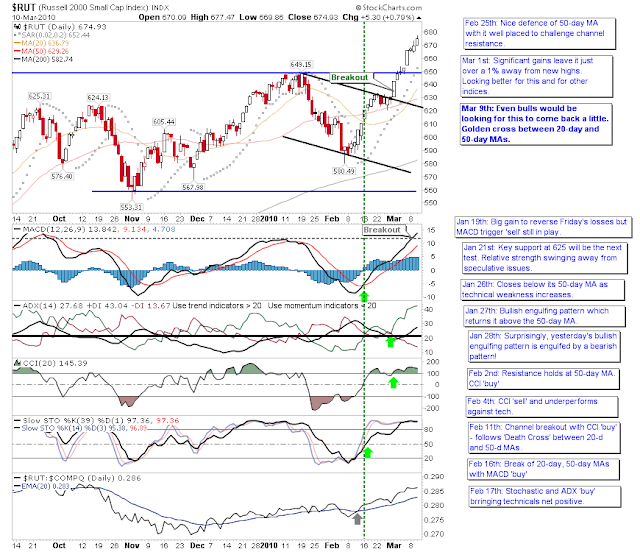

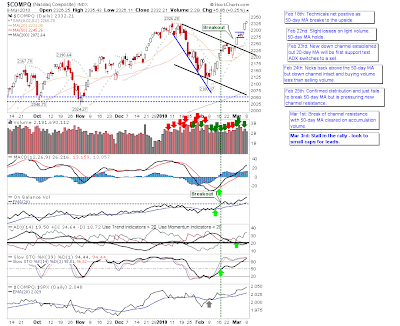

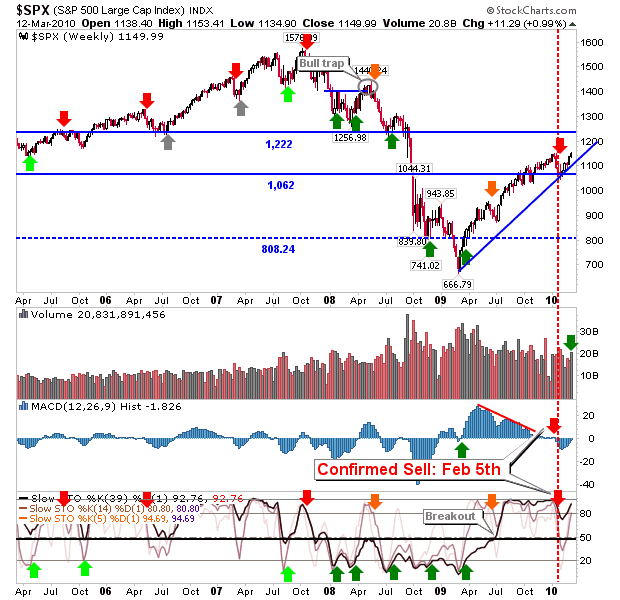

The first attempt at a top in January ceased to be with this week's close at new highs. For the S&P there is a series of reaction lows in 2008 which kick in at 1,222 and range up to 1,260. The Nasdaq has long since passed 2008 reaction lows and is fast approaching the first of the 2008 reaction highs. The Nasdaq 100 is only some 50 points away from the first of the two reaction highs in 2008; it could reach this point by the end of next week. Breadth saw significant changes. First there was a confirmed 'buy' in the Nasdaq Percentage of Stocks above 50-day MA - although it is fast approaching declining resistance. Same with the Nasdaq Summation Index (confirmed 'buy' on Mar 1st) But there was resistance break for the NYSE Summation Index on its confirmed 'buy' signal for March 8th. But not all resistance has cleared for large cap's market internals So while internals have shifted net bullish the change came from non-oversold co