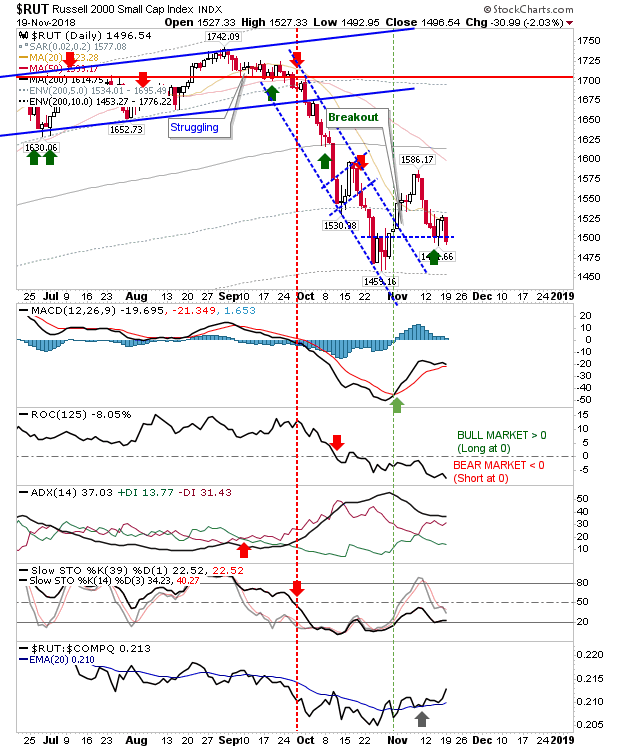

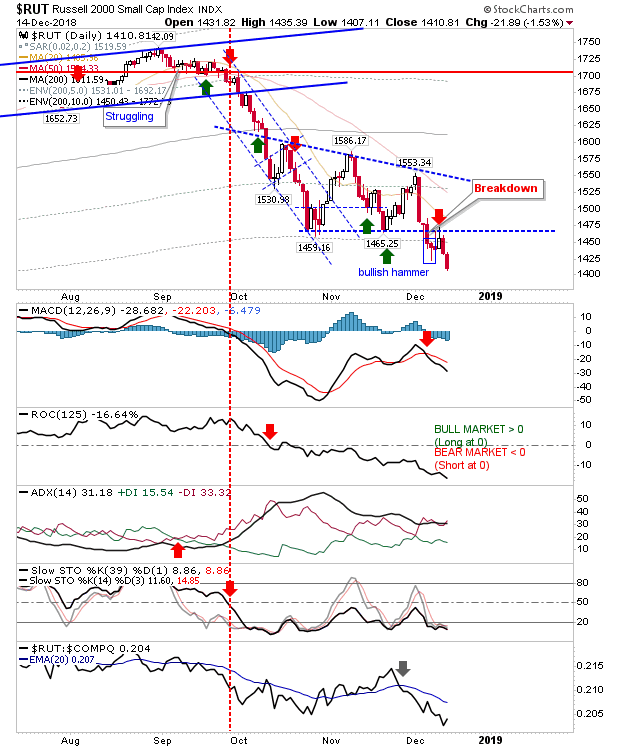

Russell 2000 takes a step lower

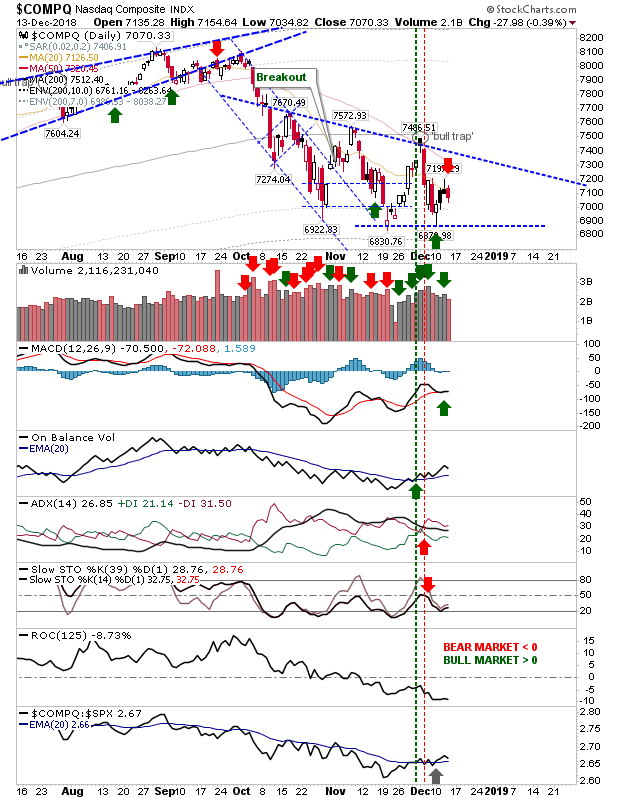

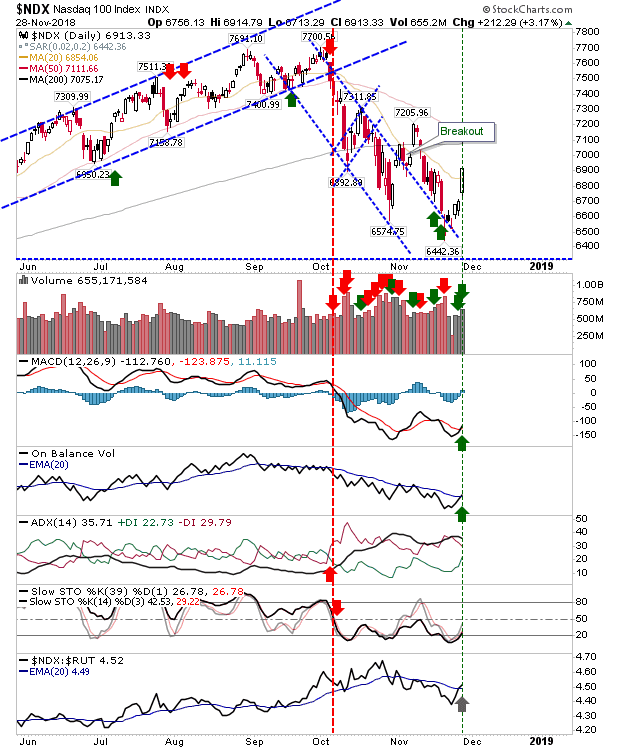

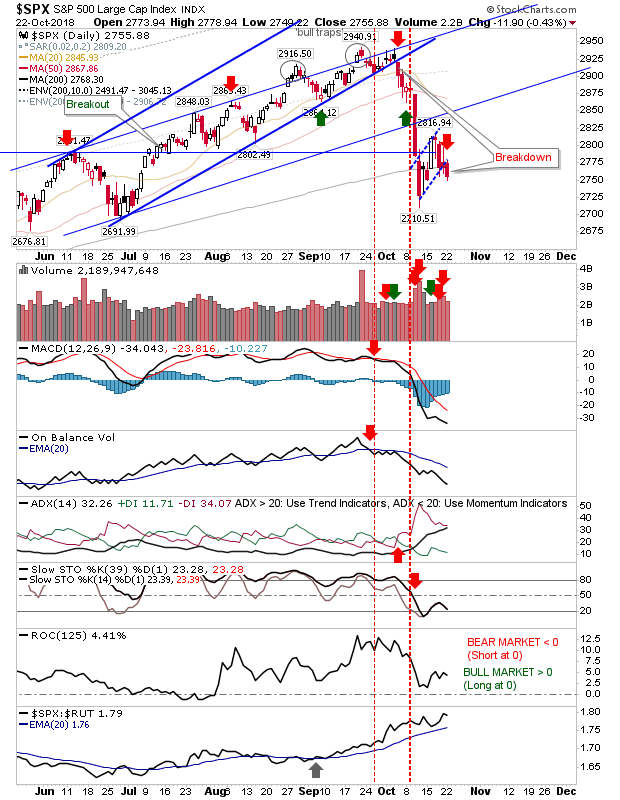

While it wasn't the biggest loser on the day, the Russell 2000 did manage to undercut the bullish hammer - ending any chance for a Santa rally of note. Look for this weakness to repeat for the S&P and Nasdaq. The Russell 2000 is still in the accumulate zone for investors and Friday was another chance to add to positions. Again, this may be only the start of the decline but without knowing what may be coming one needs to take chances as they appear.