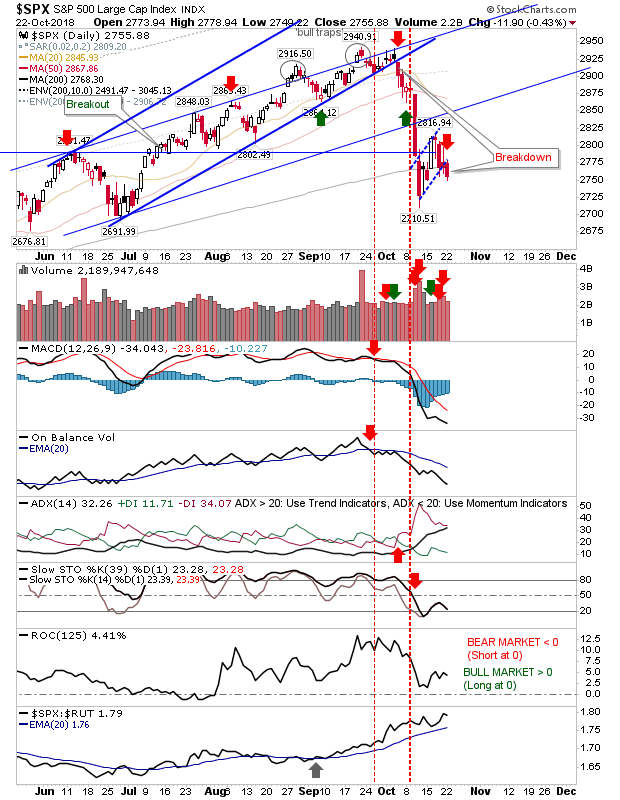

S&P Breakdown from 'Bear Flag'

There was no acceleration in the losses for the Russel 2000 and Semiconductor Index but today it was the turn of the S&P to break from its 'bear flag'. It was more of a technical break than an absolute loss but given net technical weakness, it must be respected.

The Dow also broke from its 'bear flag' but the 200-day MA is available to lend support (already lost for the S&P). Other technicals are net bearish.

Tech Indices are caught in a mixed zone. Some may argue it has already lost 'bear flag' support; others may view it at continued support.

The Russell 2000 is down trading at the recent swing low. Aggressive buyers could go long a move above 1,551 with a stop on a loss of 1,530.

For tomorrow, today's indecision probably reflects a reluctance for shorts to add to their positions and for bulls to 'sell' - this leaves the next move for buyers to come in and for shorts to cover. The basis for a rally, and maybe a challenge of prior highs, looks to be in place. If you are a short, don't get greedy. If the 'bear flags' are to play to form then decent downside has to come soon, otherwise, it will trade out flat (and into a sideways consolidation).

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for education on eToro and can be copied for free. Investments are held in a pension fund as buy-and-hold.

The Dow also broke from its 'bear flag' but the 200-day MA is available to lend support (already lost for the S&P). Other technicals are net bearish.

Tech Indices are caught in a mixed zone. Some may argue it has already lost 'bear flag' support; others may view it at continued support.

The Russell 2000 is down trading at the recent swing low. Aggressive buyers could go long a move above 1,551 with a stop on a loss of 1,530.

For tomorrow, today's indecision probably reflects a reluctance for shorts to add to their positions and for bulls to 'sell' - this leaves the next move for buyers to come in and for shorts to cover. The basis for a rally, and maybe a challenge of prior highs, looks to be in place. If you are a short, don't get greedy. If the 'bear flags' are to play to form then decent downside has to come soon, otherwise, it will trade out flat (and into a sideways consolidation).

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for education on eToro and can be copied for free. Investments are held in a pension fund as buy-and-hold.