Rallies Defended

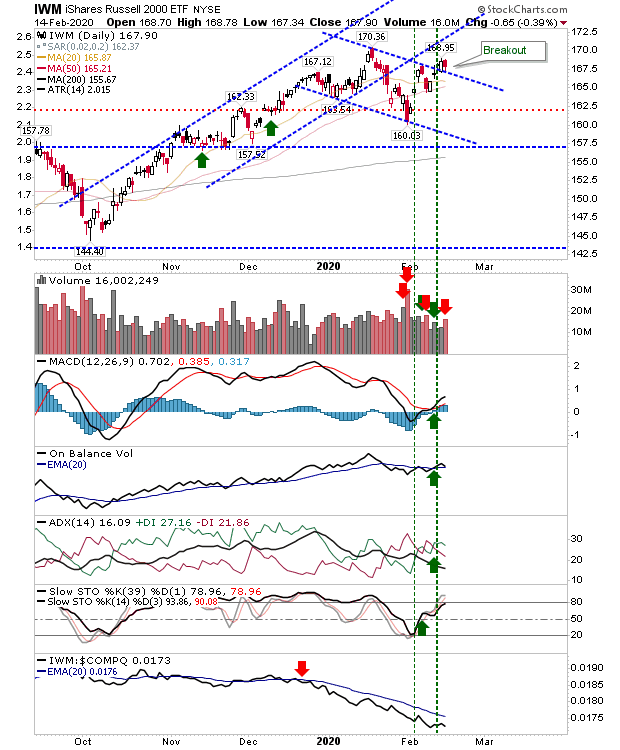

There wasn't a whole lot to Friday's action, but the one thing which was important was the successful defense of the Russell 2000 channel breakout. As a bonus, the Nasdaq is running alongside channel resistance and is ready to accelerate higher. The S&P is caught in the middle of its channel and Friday's action didn't change anything.

The Thursday breakout in the Russell 2000 gave up nearly 0.5%, but didn't reverse any of the earlier bullish technical picture.

The Nasdaq is edging up along its channel and has probably done enough to negate the shorting opportunity - marking it as a small loss. Trading volume was light but technicals are in good shape (except for a short play!).

I'll mention the S&P, only because it didn't really do anything.

It was a similar picture for the Dow Jones Industrial Average; price inside the channel.

As a final note, the Semiconductor Index is testing the most recent swing high, although it closed with a slight loss. There is a risk of a double top, but this will depend on further losses coming in quick succession.

For tomorrow, we will want to see the Russell 2000 post gains which maintain the breakout, then have the Nasdaq follow on with a breakout of its own. Large Caps have their own story to tell, but next week is unlikely to be the time.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.

The Thursday breakout in the Russell 2000 gave up nearly 0.5%, but didn't reverse any of the earlier bullish technical picture.

The Nasdaq is edging up along its channel and has probably done enough to negate the shorting opportunity - marking it as a small loss. Trading volume was light but technicals are in good shape (except for a short play!).

I'll mention the S&P, only because it didn't really do anything.

It was a similar picture for the Dow Jones Industrial Average; price inside the channel.

As a final note, the Semiconductor Index is testing the most recent swing high, although it closed with a slight loss. There is a risk of a double top, but this will depend on further losses coming in quick succession.

For tomorrow, we will want to see the Russell 2000 post gains which maintain the breakout, then have the Nasdaq follow on with a breakout of its own. Large Caps have their own story to tell, but next week is unlikely to be the time.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.