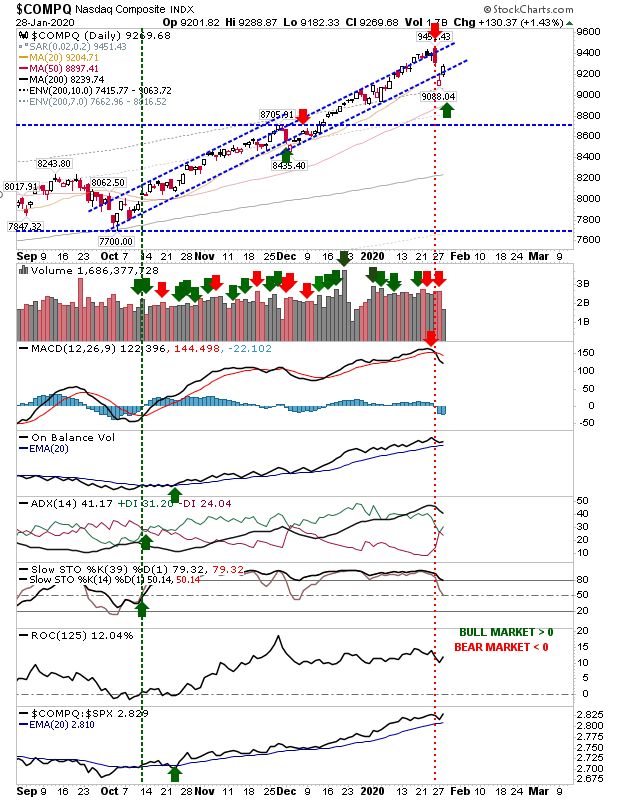

Well, it has been two days since the last post and yesterday's open started with a big gap down which started the day for the S&P below channel support (and the prospective buying opportunity), but has now left the Nasdaq in a possible buying opportunity.

For the S&P, the gap down may have been enough for value buyers but the break effectively kills the rally and likely starts a new sideways consolidation. The MACD trigger 'sell' expanded with a new 'sell' trigger in the ADX.

However, what hurt the S&P has instead helped the Dow Jones Index. Like the S&P, there was an ADX 'sell' trigger and a MACD 'sell'. The index has been sharply underperforming the Nasdaq 100 since October but a bounce from support could offer the foundation for a kick-on rally with a shift in relative performance in Large Caps favour.

On the back of losses the Nasdaq is also trading at channel support. Unlike the Dow Jones, it has the benefit of a relative performance advantage (vs the S&P), but does have the MACD trigger 'sell'.

The Russell 2000 was the first index to lose channel support. The breakdown was confirmed by a 'sell' trigger in the MACD, On-Balance-Volume and ADX; only stochastics left to switch to a net bearish picture. Relative performance remains weak.

The Semiconductor Index recovered over 2% but given it's caught between channel support and resistance it's net neutral - although with a bullish bias because of the rising trend.

For tomorrow, look for channel support rallies from the Dow and Nasdaq - the latter in particular. Longer term, a sideways consolidation of gains generated from the August acceleration (part of the broader rally from the end of 2018) looks closer to happening now after a similar pattern had started to emerge during the summer of 2019. From a trade perspective, selling covered calls against underlying long positions looks favoured.

You've now read my opinion, next read

Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are

converted into loans for those who need the help more.

Follow Me on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.