Buy Small Caps.

Today is a simple call for action. On Friday, the Russell 2000 tagged its 200-day MA in a manner which was picture perfect for those peppering the 200-day MA with GTC 'buy' orders. Monday was the second chance for a slice of this action with another tag of the 200-day MA. If there is a 200-day MA fail it will be a clean sell but as this is oversold on near-term and intermediate stochastics it's looking like a relatively low risk buy with stops on a loss of 1,615 and an initial target of 1,715 - a healthy risk:reward with the index closing at 1,630.

The S&P dug in at its 50-day MA which is another a buying opportunity. Monday finished with a bullish hammer on bearish technicals but price action looks key. Stops on a loss of 2,862, trail stops and see how it goes.

The Nasdaq took further losses as it drifts down towards its 200-day MA. Today's action marked an indecisive 'spinning top' so no clear trade on offer (aggressive longs could look to buy a close above today's high of 7,798 but the risk is measured on a loss of 7,655 which is still too wide to be attractive).

In contrast, the Dow Jones Industrials managed a bullish hammer right on channel support. While the MACD is on a 'sell' trigger, other technicals are bullish. This is an easier 'buy' trade with stops on a loss of hammer lows of 26,223 or 50-day MA.

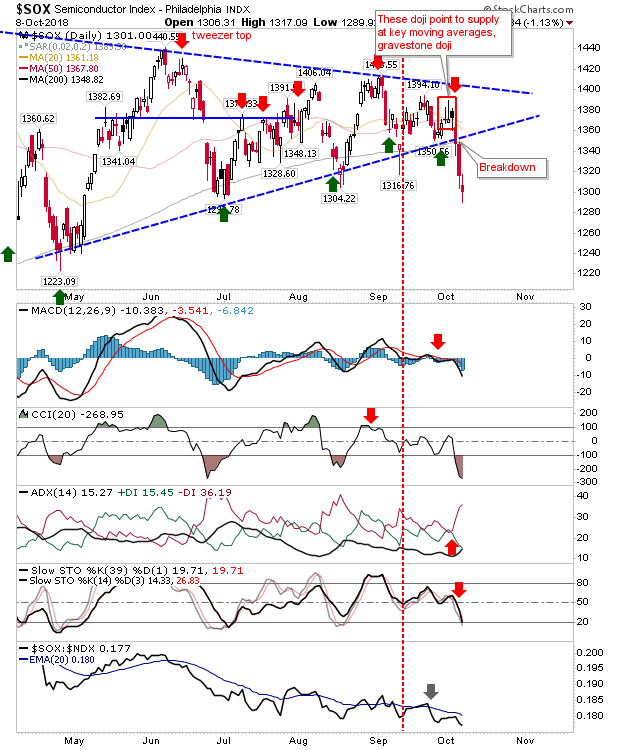

Finally, Semiconductors suffered another day's loss as it falls into a void of support. Relative performance also ticked lower after 3-months of relative calm.

For tomorrow, look to indices testing key moving averages (200-day and 50-day MA) to bounce and begin a new rally. Risk is easy to measure so if there is an undercut of these lows don't be afraid to exit the position.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for education on eToro and can be copied for free. Investments are held in a pension fund as buy-and-hold.

Dr. Declan Fallon is a blogger who trades for education on eToro and can be copied for free. Investments are held in a pension fund as buy-and-hold.

.

The S&P dug in at its 50-day MA which is another a buying opportunity. Monday finished with a bullish hammer on bearish technicals but price action looks key. Stops on a loss of 2,862, trail stops and see how it goes.

The Nasdaq took further losses as it drifts down towards its 200-day MA. Today's action marked an indecisive 'spinning top' so no clear trade on offer (aggressive longs could look to buy a close above today's high of 7,798 but the risk is measured on a loss of 7,655 which is still too wide to be attractive).

In contrast, the Dow Jones Industrials managed a bullish hammer right on channel support. While the MACD is on a 'sell' trigger, other technicals are bullish. This is an easier 'buy' trade with stops on a loss of hammer lows of 26,223 or 50-day MA.

Finally, Semiconductors suffered another day's loss as it falls into a void of support. Relative performance also ticked lower after 3-months of relative calm.

For tomorrow, look to indices testing key moving averages (200-day and 50-day MA) to bounce and begin a new rally. Risk is easy to measure so if there is an undercut of these lows don't be afraid to exit the position.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

.