Sellers Hit Out

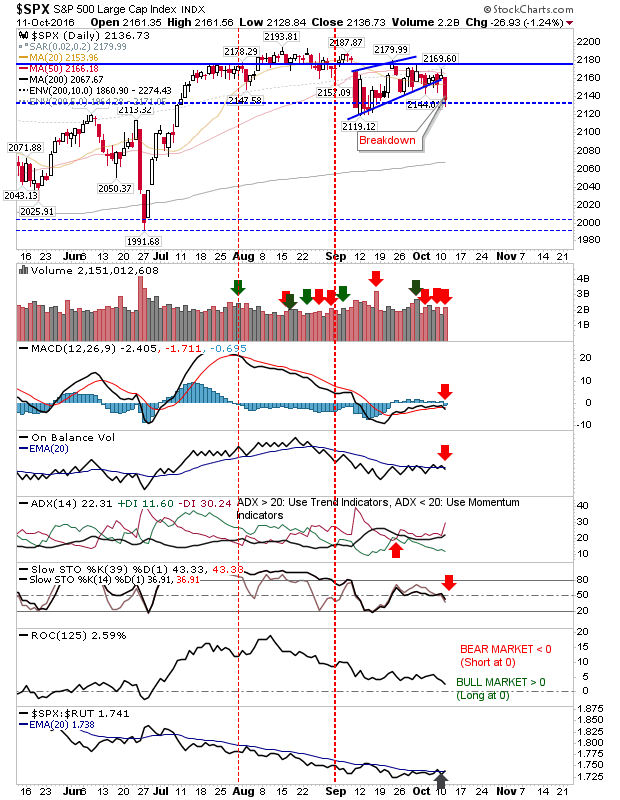

Today had the look of a decisive break down, but the last such breakdown from September's Brexit vote had a similar guise, but it failed to follow through. Volume climbed to register as another distribution day, the second (third for the S&P) such day since the last accumulation day. Tomorrow could be the decider, but it needs to break down right from the open - otherwise the agony will continue.

The S&P is back showing net bearish technicals. However, the index continues to outperform the Russell 2000.

The Russell 2000 finished the day with a 'bull trap', after a positive breakout yesterday. Technicals are mixed, although with relative performance on the wane it would appear bears have the upper hand.

The Semiconductor Index suffered big losses at over 2% for the day. It has been a strong performing index since May's low, but it may find itself experiencing more headwinds now. Technicals are moving into the bear column.

This has had a clear knock on effect on the Nasdaq and Nasdaq 100. The Nasdaq finished on its 50-day MA, much like it did in early September when it was followed by a powerful rally. Bulls may be looking for a gap (down) and rally tomorrow.

Tomorrow needs a bullish reaction, otherwise a move down to June lows becomes the preferred forecast. There is little room for maneuver for bulls after today.

You've now read my opinion, next read Douglas' and Jani's.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for ChartDNA.com, and Product Development Manager for FirstDerivatives.com. I also trade on eToro and can be copied for free.

The S&P is back showing net bearish technicals. However, the index continues to outperform the Russell 2000.

The Russell 2000 finished the day with a 'bull trap', after a positive breakout yesterday. Technicals are mixed, although with relative performance on the wane it would appear bears have the upper hand.

The Semiconductor Index suffered big losses at over 2% for the day. It has been a strong performing index since May's low, but it may find itself experiencing more headwinds now. Technicals are moving into the bear column.

This has had a clear knock on effect on the Nasdaq and Nasdaq 100. The Nasdaq finished on its 50-day MA, much like it did in early September when it was followed by a powerful rally. Bulls may be looking for a gap (down) and rally tomorrow.

Tomorrow needs a bullish reaction, otherwise a move down to June lows becomes the preferred forecast. There is little room for maneuver for bulls after today.

You've now read my opinion, next read Douglas' and Jani's.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for ChartDNA.com, and Product Development Manager for FirstDerivatives.com. I also trade on eToro and can be copied for free.