Markets Rally But Breadth Remains Weak

Monday enjoyed some follow through upside after Friday's afternoon recovery. However, gains were on very light volume given the distribution which carried most of last week. Also, market breadth remains in decline from overbought levels.

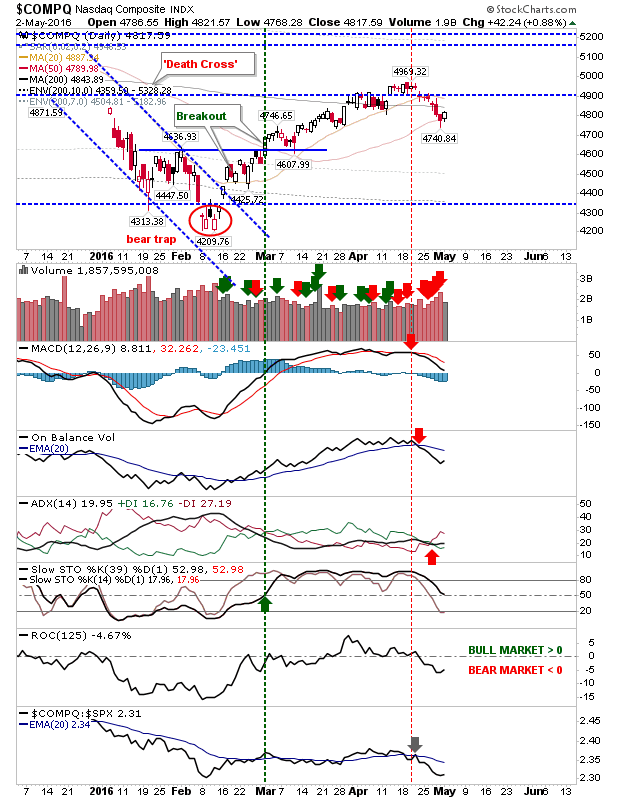

The Nasdaq frames this neatly. The rally has come off a bull defense of the 50-day MA on higher after a series of heavy volume selling days. MACD, On-Balance-Volume and +DI/-DI are in well established 'sell' triggers along with a sharp relative underperformance against the S&P. Bullish dip buyers will be pleased with today's action, but other factors are running against them.

Nasdaq breadth in the form of Percentage of Nasdaq Stocks above the 50-day MA, Summation Index and Bullish Percents all had cleared resistance, but these have since reversed from overbought levels. The question is how much downside (if any?) can be expected to follow from here. Oversold levels are a long way away, but all meaningful continuations generally follow a substantial pullback.

The S&P returned above support, and despite lagging a little behind Small Caps it's behaving strongly.

Speaking of the Russell 2000, it bounced above converged 20-day and 200-day MAs, but is doing so on the back of a MACD trigger 'sell'. Although momentum and relative performance is strongly in bulls favour.

For tomorrow, bulls should watch for continued strength from the S&P and Russell 2000. Bears will want to track breadth metrics for a reversal in expanding weakness.

You've now read my opinion, next read Douglas' and Jani's.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for ChartDNA.com, and Product Development Manager for FirstDerivatives.com. I also trade on eToro and can be copied for free.

The Nasdaq frames this neatly. The rally has come off a bull defense of the 50-day MA on higher after a series of heavy volume selling days. MACD, On-Balance-Volume and +DI/-DI are in well established 'sell' triggers along with a sharp relative underperformance against the S&P. Bullish dip buyers will be pleased with today's action, but other factors are running against them.

Nasdaq breadth in the form of Percentage of Nasdaq Stocks above the 50-day MA, Summation Index and Bullish Percents all had cleared resistance, but these have since reversed from overbought levels. The question is how much downside (if any?) can be expected to follow from here. Oversold levels are a long way away, but all meaningful continuations generally follow a substantial pullback.

The S&P returned above support, and despite lagging a little behind Small Caps it's behaving strongly.

Speaking of the Russell 2000, it bounced above converged 20-day and 200-day MAs, but is doing so on the back of a MACD trigger 'sell'. Although momentum and relative performance is strongly in bulls favour.

For tomorrow, bulls should watch for continued strength from the S&P and Russell 2000. Bears will want to track breadth metrics for a reversal in expanding weakness.

You've now read my opinion, next read Douglas' and Jani's.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for ChartDNA.com, and Product Development Manager for FirstDerivatives.com. I also trade on eToro and can be copied for free.