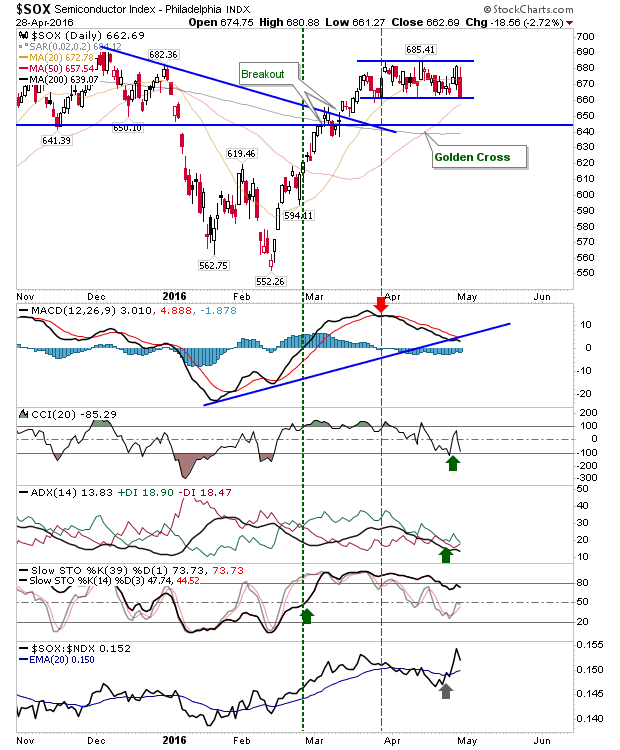

Losses All Round

There was no escape for indices as sellers achieved the sweep across markets. The Semiconductor Index suffered a big reversal, but not enough to break the horizontal congestion in play since the end of March. And only clawed back some of the relative out-performance against indices such as the Nasdaq 100.