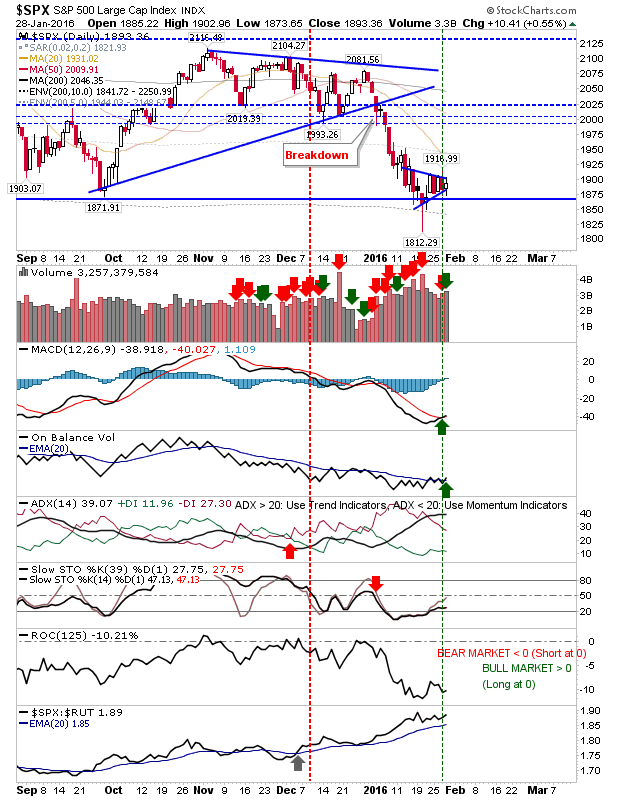

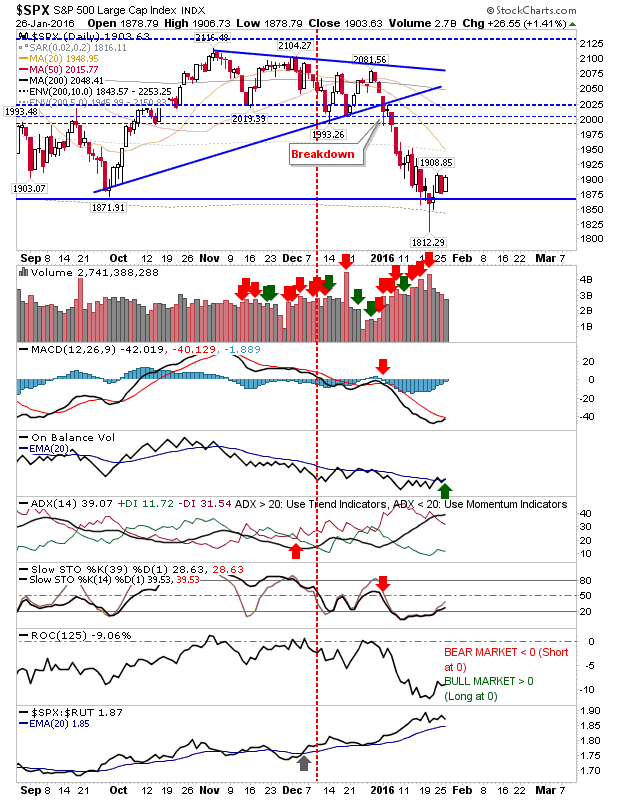

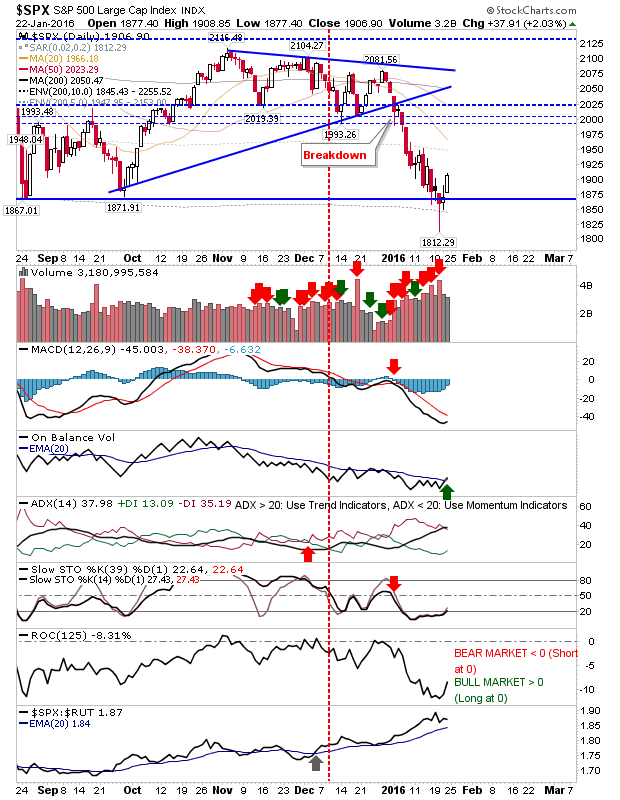

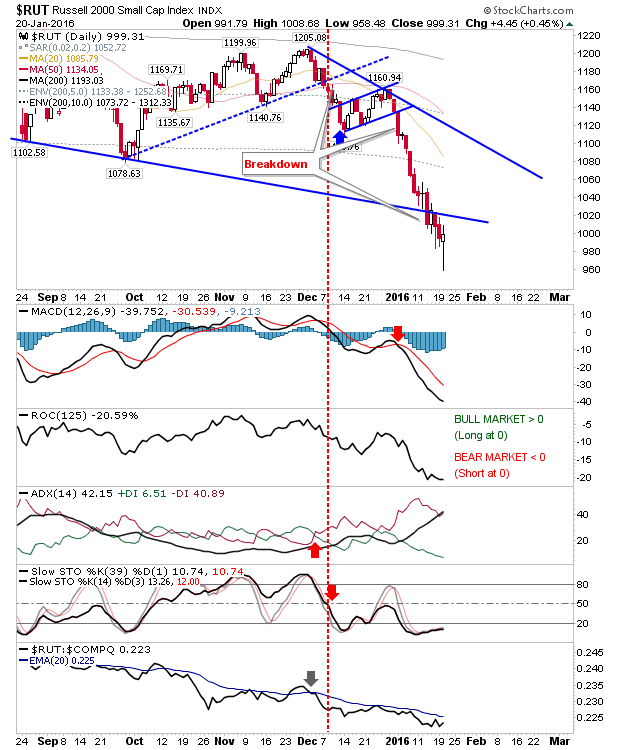

Counter Break of Consolidation

Markets were setting up for a push lower, but Friday's upside break from consolidations triggered a wave of buying (and short covering). The buying was accompanied with higher volume accumulation. Shorts were left squealing by Friday's action, and new shorts will need to wait until Nov-Dec consolidations are tested before new positions are entered. Until then, short covering and long buyers rule the day. The S&P has taken the first step of a rally to take it back to the supply zone of 2,000. Friday's action was accompanied by a MACD trigger 'buy' and On-Balance-Volume 'buy' trigger.