Daily Market Commentary: Russell 2000 Breakdown

Sellers brought with them volume, but only the Russell 2000 finished the day with a breakdown. The Russell 2000 is trading within a larger, and more significant consolidation, but today's break ends the July-September rally, or at least broadens it. The presence of key moving averages offers additional support to work with, first of which is today's test of the 50-day MA.

The S&P is down at 1,987 support and the 20-day MA. Higher volume marked distribution, but the breakout is intact.

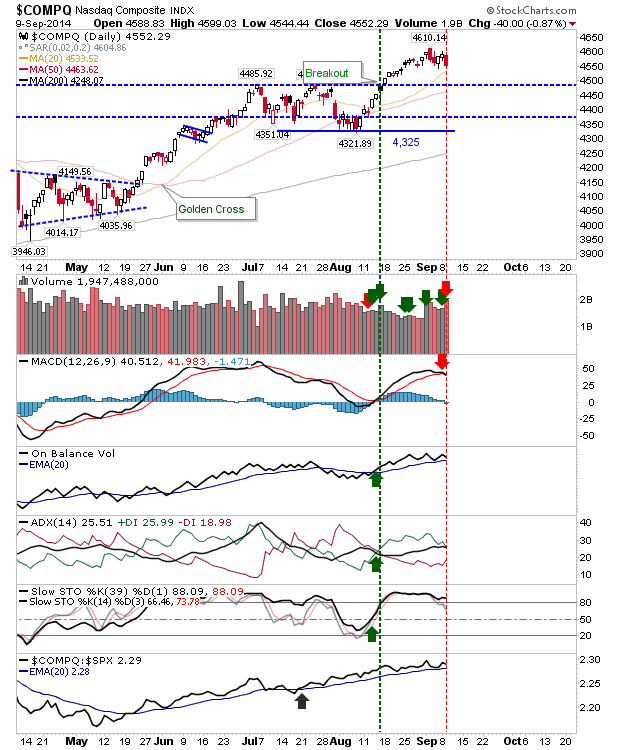

The Nasdaq had the quietest day, but today's distribution didn't break any low. There is a MACD trigger 'sell' which may offer shorts something with a stop above 4,610. The 20-day MA will be the first port of call on the way down and a gauge of sideline money.

As a sidenote, the Semiconductor index did lose out and confirm the bearish inverse hammer. The 20-day MA is still some distance below, so this is the index most likely to suffer additional losses.

For tomorrow, look for follow on losses in Semiconductors, with undercuts of trading ranges in the Nasdaq and S&P. The Russell 2000 has already lost out, so it's hard to see it suffering a second day of losses given the proximity of converged 20-day and 50-day MA support.

----

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The S&P is down at 1,987 support and the 20-day MA. Higher volume marked distribution, but the breakout is intact.

The Nasdaq had the quietest day, but today's distribution didn't break any low. There is a MACD trigger 'sell' which may offer shorts something with a stop above 4,610. The 20-day MA will be the first port of call on the way down and a gauge of sideline money.

As a sidenote, the Semiconductor index did lose out and confirm the bearish inverse hammer. The 20-day MA is still some distance below, so this is the index most likely to suffer additional losses.

For tomorrow, look for follow on losses in Semiconductors, with undercuts of trading ranges in the Nasdaq and S&P. The Russell 2000 has already lost out, so it's hard to see it suffering a second day of losses given the proximity of converged 20-day and 50-day MA support.

----

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!