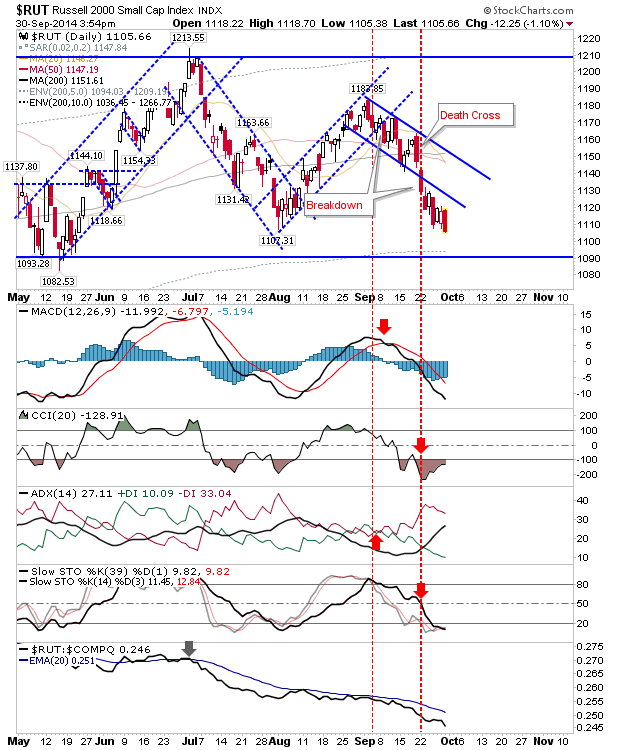

Small Caps take the brunt of selling

The aversion to risk continued with Small Caps edging a break below the July swing low on a loss of nearly 1.5%. However, the larger trading range is intact until 1,090 is lost. The 200-day MA is also nearby to lend support. As for today's action, more selling is favored for tomorrow, although action in other indices isn't pointing so bearish.

The S&P finished with a more neutral candlestick, although it again failed to recover 1,987 and the 50-day MA. However, relative performance against the Russell 2000 took another big step higher.

The Nasdaq experienced extensive distribution selling, but it hasn't yet closed below 4,485. However, it did edge a close below 4,498. If the index is able to rally above the 50-day MA tomorrow it might offer another long opportunity (using the lows of a 'bear trap' as a stop).

The semiconductor index ended with an inside day and a chance for a step down move towards the marked convergence bounce zone.

For tomorrow, bears probably have an edge, particularly for the Russell 2000. It has been a long time since any index has ventured to, or below, its 200-day MA; but the Russell 2000 looks like it will be the index to do so (in the coming weeks).

Tweet

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The S&P finished with a more neutral candlestick, although it again failed to recover 1,987 and the 50-day MA. However, relative performance against the Russell 2000 took another big step higher.

The Nasdaq experienced extensive distribution selling, but it hasn't yet closed below 4,485. However, it did edge a close below 4,498. If the index is able to rally above the 50-day MA tomorrow it might offer another long opportunity (using the lows of a 'bear trap' as a stop).

The semiconductor index ended with an inside day and a chance for a step down move towards the marked convergence bounce zone.

For tomorrow, bears probably have an edge, particularly for the Russell 2000. It has been a long time since any index has ventured to, or below, its 200-day MA; but the Russell 2000 looks like it will be the index to do so (in the coming weeks).

Tweet

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!