Daily Market Commentary: Buyers Not Ready Yet

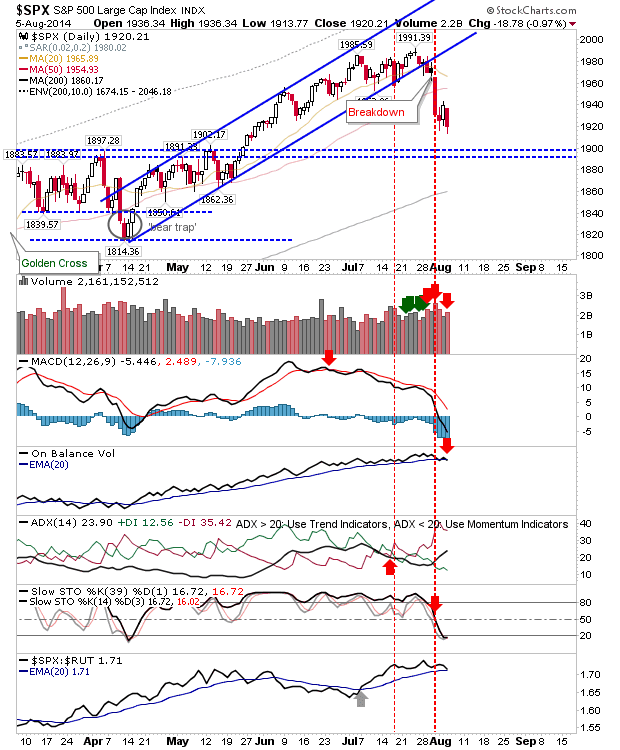

Monday's rally was brief and didn't trigger any follow through. Sellers pounced, hitting Large Caps hard, but leaving no index unscathed.

Volume climbed to register distribution for the S&P, posting a new low for the July/August decline and came close to a potential new closing low. The 1,900 level is looking like the next stop down: watch for an intraday tag as this could be a good day trade on the bounce.

Those looking for a swing trade can focus on the Nasdaq. Confirmation of a long will come on a close above the 50-day MA, a short will offer itself on a break of Friday's low (with a 200-day MA target).

Although the swing trade favours bears if you are a follower of the Nasdaq Summation Index.

While the Russell 2000 hasn't yet reached May support it is indicating a possible bounce, perhaps going as far as the fast falling 20-day MA, with potential follow through to the 200-day MA.

The Dow had an ugly day, but it's about to tag the 200-day MA; a good long side opportunity.

Tomorrow offers a second chance for bulls to step in, but Monday's buyers will be biting their nails if there is any bearish follow through in the morning. A hard sell off in the first hour would offer another value opportunity, particularly for the Dow and maybe the Russell 2000 too. The Nasdaq has the 50:50 opportunity.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

Volume climbed to register distribution for the S&P, posting a new low for the July/August decline and came close to a potential new closing low. The 1,900 level is looking like the next stop down: watch for an intraday tag as this could be a good day trade on the bounce.

Those looking for a swing trade can focus on the Nasdaq. Confirmation of a long will come on a close above the 50-day MA, a short will offer itself on a break of Friday's low (with a 200-day MA target).

Although the swing trade favours bears if you are a follower of the Nasdaq Summation Index.

While the Russell 2000 hasn't yet reached May support it is indicating a possible bounce, perhaps going as far as the fast falling 20-day MA, with potential follow through to the 200-day MA.

The Dow had an ugly day, but it's about to tag the 200-day MA; a good long side opportunity.

Tomorrow offers a second chance for bulls to step in, but Monday's buyers will be biting their nails if there is any bearish follow through in the morning. A hard sell off in the first hour would offer another value opportunity, particularly for the Dow and maybe the Russell 2000 too. The Nasdaq has the 50:50 opportunity.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!