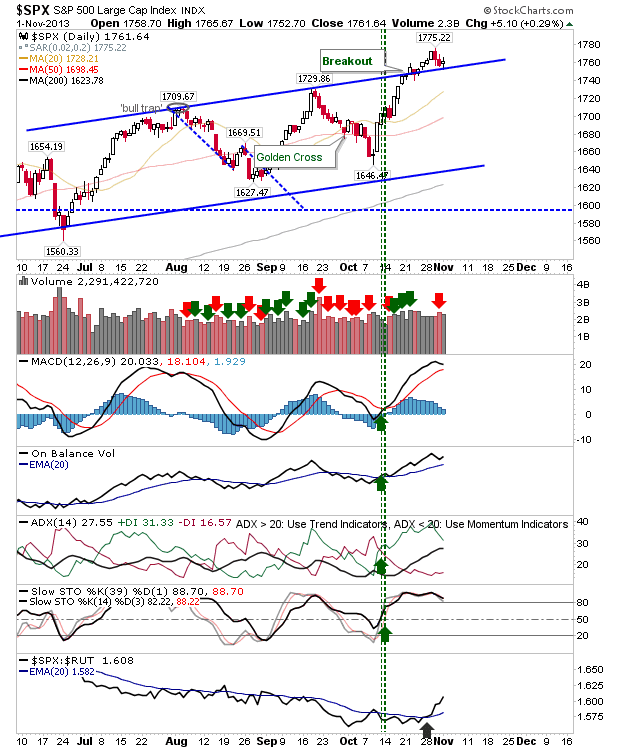

Markets have been making baby steps up or down, but the one thing they haven't been able to hide is the broader swing back to Large Cap stocks, and away from speculative Small Cap and Technology stocks. It's a growing flight to safety which will benefit S&P buyers, but is an indication of a larger move down - likely a test of 50-day MAs at least.

With the S&P attracting what monies are coming from the sidelines, it will be important former channel resistance turned support holds. Otherwise a shortable 'bull trap' will emerge.

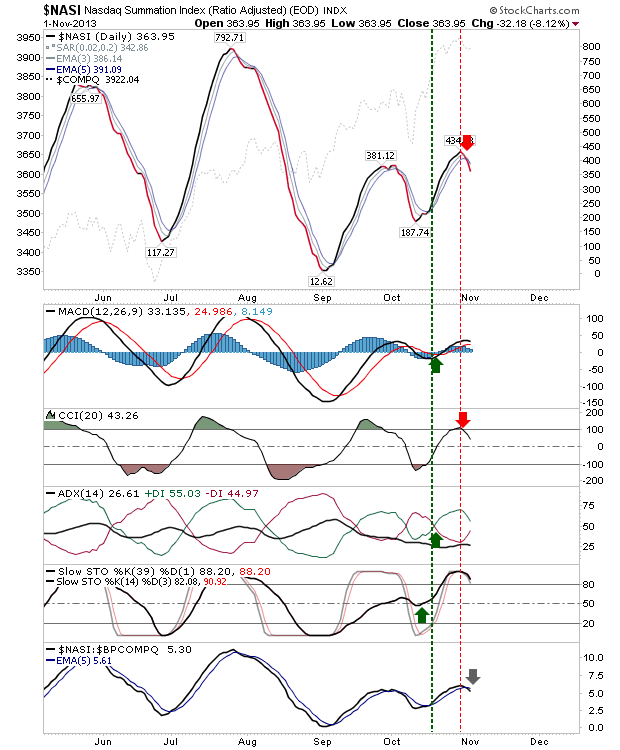

In light of this, the Nasdaq is in a similar predicament, but lacking the undercurrent of buying to suggest it can hold. Thursday's distribution selling was greater than that of the S&P. A MACD 'sell' trigger has edged in.

Nasdaq Breadth has created a more definitive swing top, although the Nasdaq Bullish Percents would need to drop below the June low of 64% to suggest a more prolonged decline to follow. As it stands, even with the possibility of a 'bull trap' in the parent index (Nasdaq), buyers are likely to rush in at 20-day or 50-day MAs.

Technicals are net bearish in the Percentage of Nasdaq Stocks Above 50-day MA, but there is a thick band of support in the 43-46% range. If this zone breaks, look for an acceleration in the losses. Until then, it's likely to be baby steps down.

The Nasdaq Summation Index has always been my preferred breadth metric because of its smooth moves and relatively timely turns. It too is offering a 'profit take' signal, but hasn't yet suggested a 'buy' as technicals are only rolling over from a top.

Small Caps will probably have bounce traders interested as it's the first index to make it to its 20-day MA. And, it has also reached support of the October breakout. Technicals are weakening, and not offering a strong 'buy' - so look for this to be a trader's bounce, perhaps lasting a couple of days. At that point, take some profits and tighten stops to breakeven to see if it evolves to something better.

Futures are so far pointing to a

slightly higher open.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!