In what amounted to a follow through from days of inaction, markets took a step higher on some decent volume (accumulation).

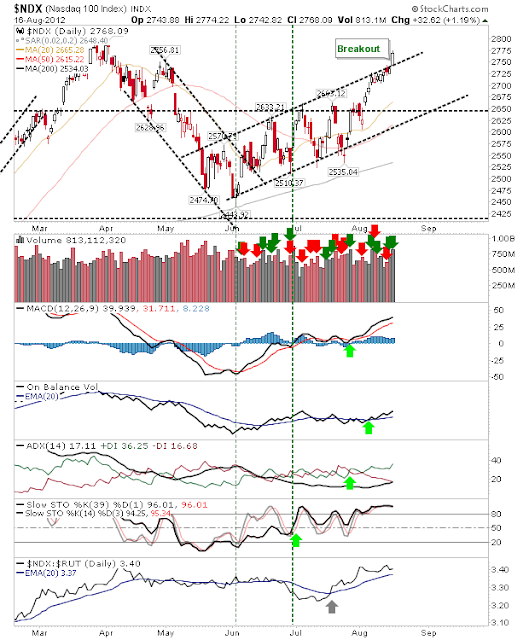

The index to make the most of the leap was the breakout - albeit of rising channel resistance - in the Nasdaq 100.

Next on the hit list is a challenge to clear 2,790, but it's looking good for tech stocks.

Helped in part by some strong recovery action in Semiconductors; note the rise in relative strength between Semiconductors and the Nasdaq 100 since the July swing low. This is an indication of leadership from bullish-economic sensitive sectors; good news going into 2013 for the economy.

Small Caps were another index to shine. There was a solid pop above mini-resistance of 803 and heading into an area of resistance around 820.

If there is a cautionary tale it's in the VXN. It's fast approaching its all-time low from 2005. This in itself isn't an immediate problem, but it started a gradual rise which eventually culminated in 2008 crash (although it took the best part of 3 years from that point to happen).

But altogether, it was a solid day for indices.

---

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com. I offer a range of stock

trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the

Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental

stock alerts,

stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed

stock quote watchlists, multi-currency

portfolio manager, active

stock screener with fundamental trading strategy support and

trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!