Daily Market Commentary: Holiday Trading Continues

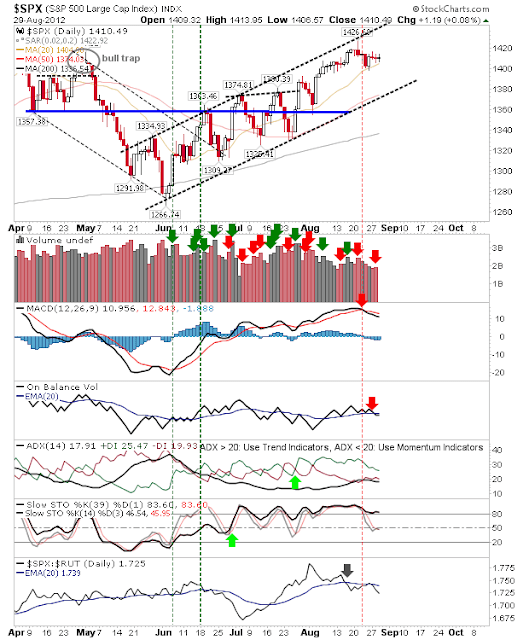

There is only a couple vacation days left for August and this continues to be reflected in trading volume. The S&P continues to hold 20-day SMA support with a third doji in a row.

The semiconductor index is holding horizontal support at 396 and its 20-day MA. The past five days have seen some very tight trading, so a big response can be expected soon. Will Monday be the day this breaks the malaise?

The Russell 2000 is the index most likely to break first. It is carefully poised on resistance and may make its move as soon as tomorrow.

The one index to show a technical weakness was the Nasdaq 100 with its 'sell' trigger in the MACD. However, the index itself remains above channel resistance and hasn't shown any price weakness.

Not expecting much from tomorrow given the volume.

---

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The semiconductor index is holding horizontal support at 396 and its 20-day MA. The past five days have seen some very tight trading, so a big response can be expected soon. Will Monday be the day this breaks the malaise?

The Russell 2000 is the index most likely to break first. It is carefully poised on resistance and may make its move as soon as tomorrow.

The one index to show a technical weakness was the Nasdaq 100 with its 'sell' trigger in the MACD. However, the index itself remains above channel resistance and hasn't shown any price weakness.

Not expecting much from tomorrow given the volume.

---

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!