Markets rallied on

positive economic data from the IMF, German economy and Spanish bond prices. The rally helped re-establish support at 50-day MAs for the Nasdaq and S&P, although the Russell 2000 is about to generate a bear cross between its 20-day and 50-day MA.

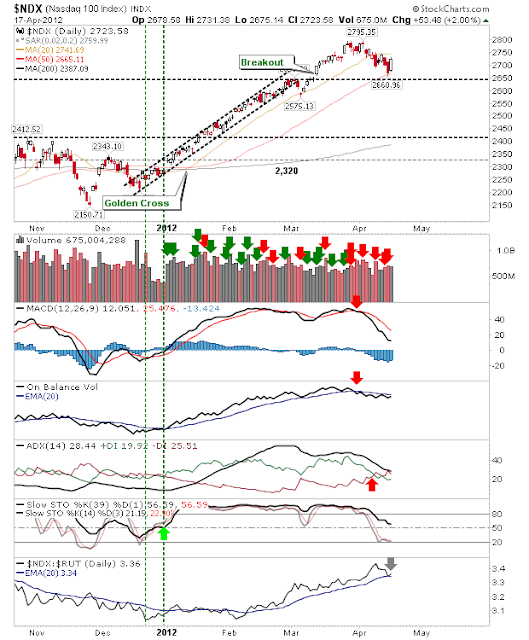

The biggest winner on the day was the Nasdaq 100. It's 2.00% gain was driven by its prior defense of its 50-day MA. Technicals are clinging to their bullish picture, although ADX, On-balance-volume and the MACD are in decline.

The S&P regained its 50-day MA, but today's gain left it just below its 20-day MA. But...

The Dow rallied into its prior 'bull trap' and was able to regain its 20-day MA; good news for indices which are trading just below theirs. Technicals were even able to stage a recovery with a bull cross for on-balance-volume and ADX.

The Russell 2000 is the index most in trouble. The potential 'death cross' between its 20-day and 50-day MA will offer shorts something to work with. But short covering will likely drive a break of its 50-day MA.

Overall, volume was disappointing, but 50-day MAs have been successfully defended and can be used as stops for long side positions in the Nasdaq, Nasdaq 100 and S&P. Shorts will look to attack the Russell 2000 unless there is a break of the 50-day MA.

---

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com. I offer a range of stock

trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the

Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental

stock alerts,

stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed

stock quote watchlists, multi-currency

portfolio manager, active

stock screener with fundamental trading strategy support and

trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!