Daily Market Commentary: Tight Trading

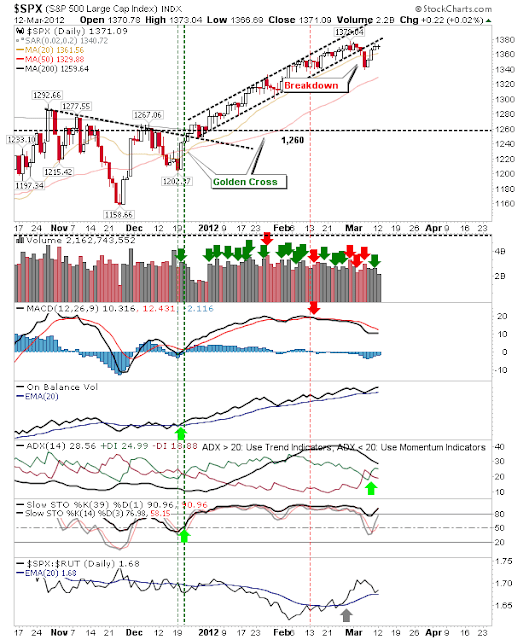

Monday traded like a holiday with low volume and a narrow intraday range. It was no coincidence this action occurred near resistance, with bulls doing little to challenge it. The S&P posted a small doji just below the February high. Technicals hed firm with the MACD on course to trigger a 'buy' and reverse its one bearish indicator. Swing traders can use a break of Monday's doji high/lows as the basis for a trade. The Nasdaq experienced a similar day, closing slightly down. The index is sitting on the cusp of a challenge on 3,000. But semiconductors suggest the Nasdaq might have to wait a little longer before it breaks 3,000. Today's semiconductor action was a clear reversal of Friday's gain, below February's congestion and away from its 20-day MA. Small Caps are attempting a move inside the February congestion zone but it's encountering supply at its 20-day MA; a moving average both Nasdaq and S&P have cleared. On Tuesday, l...