Daily Market Commentary: Recovers Early Losses

It was a decent show by bulls after a weak open threatened to do more damage. Indices clawed enough of their losses to finish near Monday's highs.

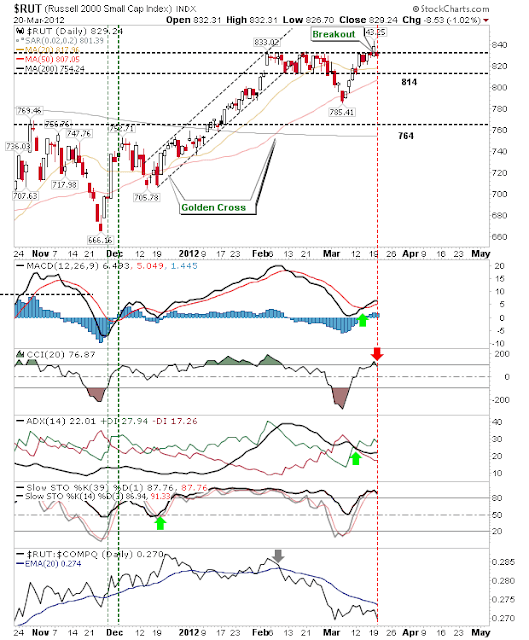

For the weaker of the indices it leaves things a little on tenterhooks. The Russell 2000 finished just below the 833 area which helped define Monday's breakout. If this is not to 'bull trap' it will need 833 regained over the next couple of days, or at least not pull away from it (The 20-day MA is looking the natural buffer zone for 'bull trap' confirmation).

The semiconductor index is still well positioned to challenge 440. Yesterday's tight trading suggests there isn't much overhead supply or profit takers left to sell, it just needs to break the psychological 440 barrier to encourage buyer participation from the sidelines. Technicals are in good shape.

One index was able to take something positive from the day. The Nasdaq 100 continued its advance, even managing to score a modest accumulation day (although emphasis on the 'modest'). The index is up almost 30% in 4 months - quite the rise.

For Wednesday it's going to be more of the same. When the market turns it will be the Russell 2000 to lead down and it's currently the index most vulnerable to a sell off - especially after Monday's pop above then Tuesday's drop below 833 resistance. The Nasdaq 100 is the most bullish index and shows no signs of slowing - but if it can retain its momentum it will help the semiconductor index break above 440; likely the index to offer the most to bulls.

-----

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

For the weaker of the indices it leaves things a little on tenterhooks. The Russell 2000 finished just below the 833 area which helped define Monday's breakout. If this is not to 'bull trap' it will need 833 regained over the next couple of days, or at least not pull away from it (The 20-day MA is looking the natural buffer zone for 'bull trap' confirmation).

The semiconductor index is still well positioned to challenge 440. Yesterday's tight trading suggests there isn't much overhead supply or profit takers left to sell, it just needs to break the psychological 440 barrier to encourage buyer participation from the sidelines. Technicals are in good shape.

One index was able to take something positive from the day. The Nasdaq 100 continued its advance, even managing to score a modest accumulation day (although emphasis on the 'modest'). The index is up almost 30% in 4 months - quite the rise.

For Wednesday it's going to be more of the same. When the market turns it will be the Russell 2000 to lead down and it's currently the index most vulnerable to a sell off - especially after Monday's pop above then Tuesday's drop below 833 resistance. The Nasdaq 100 is the most bullish index and shows no signs of slowing - but if it can retain its momentum it will help the semiconductor index break above 440; likely the index to offer the most to bulls.

-----

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!