Daily Market Commentary: Small Caps Struggle - A Little...

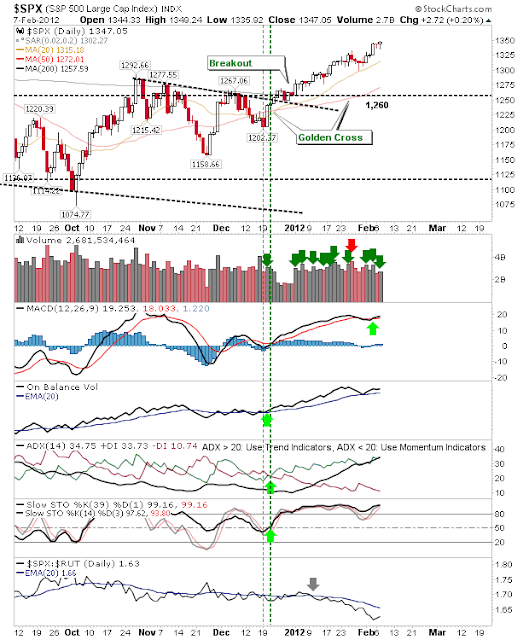

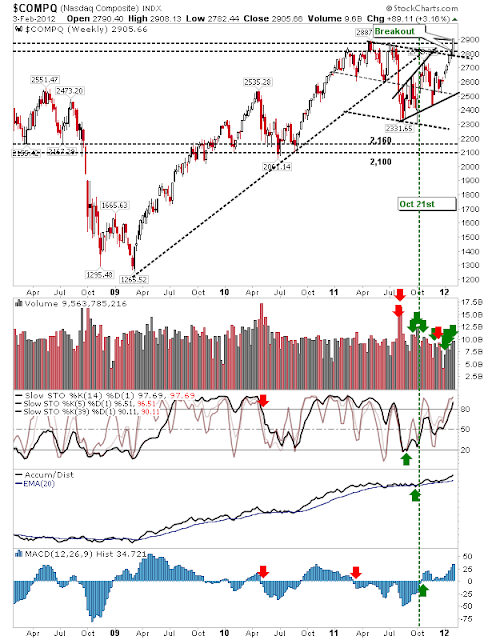

The sequence of low point gains on heavier volume continued. The only index to buck the trend was the Russell 2000. However, it's losses were as small as gains in other indices. In addition, small losses weren't enough to knock the index outside of a rising channel, but relative strength has shifted away from Small Caps towards Tech averages (and S&P). The Nasdaq may have added less than 0.5%, but trading volume was significantly heavier. The index remains in good shape as it rides along channel resistance. The S&P continued with another of its narrow range days. Markets ticked higher at a solid pace. Recent gains leave the index well positioned to move higher or at least tolerate a small loss and remain bullish. The Russell 2000 is looking like it will be the index to first test support of narrow rising channels. Watch it closely for leads. ------- Follow Me on Twitter Dr. Declan Fallon is the Senior Market Technician and Community Di...