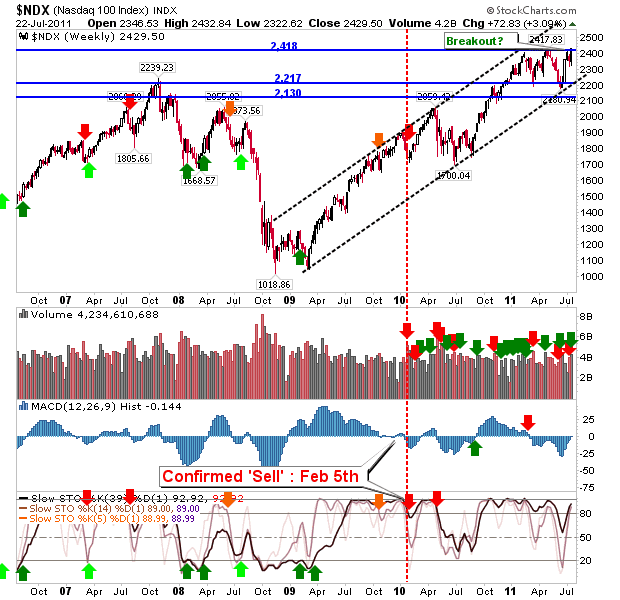

The week finished with a fresh breakout for the Nasdaq 100. This index continues to reward bulls since taking out its 2007 high. Technicals remain good and the index has enjoyed heavier volume accumulation dating back to October 2010. No reason to doubt the momentum.

While the Nasdaq 100 leads the way, the Nasdaq is poised to follow. The Nasdaq chart looks good as it trades well inside the trend channel, so it has room to move sideways as overhead supply is consumed.

The Russell 2000 hasn't pushed enough to take out the 'bull trap'. But like the Nasdaq, it is well inside its rising channel and is lurking near resistance. With speculative money favouring tech stocks it may yet see some trickle down benefit ahead of the S&P

The S&P is also in a position to take out the nearest swing high, but it's a long way from the 2007 high which other indces are challenging - or have already beaten.

The main points of concern for both the Nasdaq and S&P are the bearish divergences in market breadth. I have given the Bullish Percents as an example, but problems lie in the Percentage of Stocks above the 50-day MA and Summation Indices. The caveat to this is that bearish divergences can remain in effect for a *long* time before markets eventually reverse. But it's a warning markets are in their end phase for the rally.

For next week, look to the Nasdaq 100 to build on its breakout and take the Nasdaq higher with it.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com. I offer a range of stock

trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the

Zignals Trading Strategy Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental

stock alerts,

stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed

stock quote watchlists, multi-currency

portfolio manager, active

stock screener with fundamental trading strategy support and

trading system builder. Forex, precious metal and energy commodities too. Build your own

trading system and sell your

trading strategy in our MarketPlace to earn real cash.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN US TODAY - IT'S FREE!