Weekly Market Comentary: Nasdaq Summation Index Bottom?

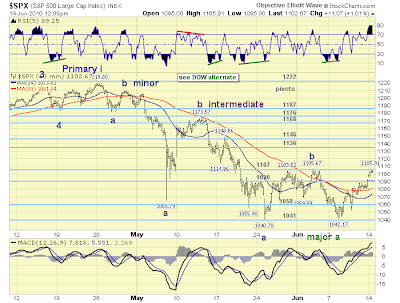

The indices made managed modest gains on the week. The S&P dug in at 1,062 and finished the week up over 2% as stochastics continued their downward descent (of which stochastics are not oversold). Volume has been falling since the peak so it's not great news for this rally continuing beyond a couple of weeks. ($SPX) via StockCharts.com The Nasdaq similarly drifted below the bullish mid-line (50) of stochastics as it looked to garner support. The first fibonacci support level at 2,050 is still some 250 points below; so it is a little early to be calling a bottom. Volume was disappointing. Nasdaq via StockCharts.com The one key aspect working in its favour is the picture perfect support bounce in the Nasdaq Summation Index from the broadening wedge; support working off a reaction bottom of -777 (below my unofficial -600 'buy' trigger line). Additional support found in stochastics - watch for a confirmed 'buy' soon. ($NASI) via StockCharts.com The Perc...