Weekly Review of Stockcharts.com Publisher Charts

US Futures are suggesting a bright start for Monday so with that what had the Stockcharters to say about last week?

We open with Richard Lehman of the Channelist. He talks above gains lasting another couple of day before things get toasty (he also plugs his new newseletter!).

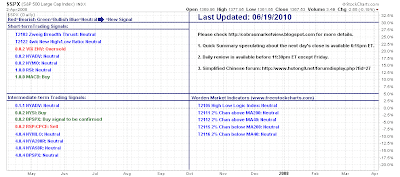

Yong Pan of Cobrasmarketview.blogspot.com offers a still quite remarkable neutral picture.

Ad-hoc adjustment for mechanical trading system

Early indications for a 'Buy' Signal? Candlesticks would suggest more indecision though

Same indecision for the QQQQ

Michael Eckert of EWTrendsandcharts.blogspot.com offers two alternatives for the end of the 2nd wave (SPX 60-min).

Ted Burge of theTedlines.com highlights the battle in the NDX between 1,902 support atnd the 50-day MA.

Dr. Joe goes with his summary:

Retail index finding support

As volatility trends down from its peak (bullish for S&P)

Nasdaq Summation Index working on a new 'buy'

Finally, Robert New shows how the 50-week and 70-week EMAs continue to play as support (not just for the S&P, but Russell 2000 and Tech averages too)

We will see how Monday plays out for the markets...

Follow Me on Twitter

Build a Trading Strategy in Zignals; Read how and earn real money (once out of Beta) in this PDF.

Dr. Declan Fallon, Senior Market Technician for Zignals.com, offers a range of stock trading strategies for global markets, also available through the latest rich internet application for finance, the Zignals MarketPortal or the Zignals Trading Strategy MarketPlace.

Zignals offers a full suite of financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock list watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too.

Build your own trading system and sell your trading strategy in our MarketPlace to earn real cash. Read what others are saying about Zignals on Investimonials.com.

JOIN US TODAY - IT'S FREE!

We open with Richard Lehman of the Channelist. He talks above gains lasting another couple of day before things get toasty (he also plugs his new newseletter!).

6/20 -- First, Happy Fathers Day, fellow Dads!

Second, THE CHANNELIST NEWSLETTER is now available by subscription. The only way I can continue doing this much work is to charge a nominal amount. Please go to www.Channelist.com for info and to subscribe. This week's letter will be available today.

Third, it looks like the markets could squeeze out another up day or two, but there is big resistance to going much further in both short and long term channels without a pull-back. Momentum is waning and stochastics are in or approaching overbought extremes. But there is a bullish long term case that says the entire correction is over -- I illustrate this possibility in the Channelist this weekend.

6/17 -- The last minute spurt by large caps is somewhat suspect since it wasn't widespread -- though it did keep the large caps in their blue minichannels. Expiration Friday could do almost anything, but I think the next move is down at the mini level.

6/16 -- The break of purple downtrends is solid now, but in the process, a number of indexes are getting toppy and will likely falter very soon. XLE and XLF are two to be careful of as they have hit upper short term lines. XAU may also be vulnerable to any little pullback in the price of gold.

6/15 -- Today certainly nailed the coffin on the purple short term downchannels. The blue minis chugged right along to the upside and even retested the purples before continuing upward. In most of the charts, we don't have the benefit of a good upside target in the short term -- but we do in the RUT. Drawn differently, the RUT didn't even break its purple yet, and that may give us an upside target (675-680 on the RUT).

Meanwhile long term channels still of course head down all over, but their widths and slpes are adjusting due to this push upward. The RUT looks good here also, as the purple on the one-year chart comes right off the flashcrash low and connects with two other bottoms.

Yong Pan of Cobrasmarketview.blogspot.com offers a still quite remarkable neutral picture.

Ad-hoc adjustment for mechanical trading system

Early indications for a 'Buy' Signal? Candlesticks would suggest more indecision though

Same indecision for the QQQQ

Michael Eckert of EWTrendsandcharts.blogspot.com offers two alternatives for the end of the 2nd wave (SPX 60-min).

Ted Burge of theTedlines.com highlights the battle in the NDX between 1,902 support atnd the 50-day MA.

Dr. Joe goes with his summary:

Retail index finding support

As volatility trends down from its peak (bullish for S&P)

Nasdaq Summation Index working on a new 'buy'

Finally, Robert New shows how the 50-week and 70-week EMAs continue to play as support (not just for the S&P, but Russell 2000 and Tech averages too)

We will see how Monday plays out for the markets...

Follow Me on Twitter

Build a Trading Strategy in Zignals; Read how and earn real money (once out of Beta) in this PDF.

Dr. Declan Fallon, Senior Market Technician for Zignals.com, offers a range of stock trading strategies for global markets, also available through the latest rich internet application for finance, the Zignals MarketPortal or the Zignals Trading Strategy MarketPlace.

Zignals offers a full suite of financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock list watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too.

Build your own trading system and sell your trading strategy in our MarketPlace to earn real cash. Read what others are saying about Zignals on Investimonials.com.

JOIN US TODAY - IT'S FREE!