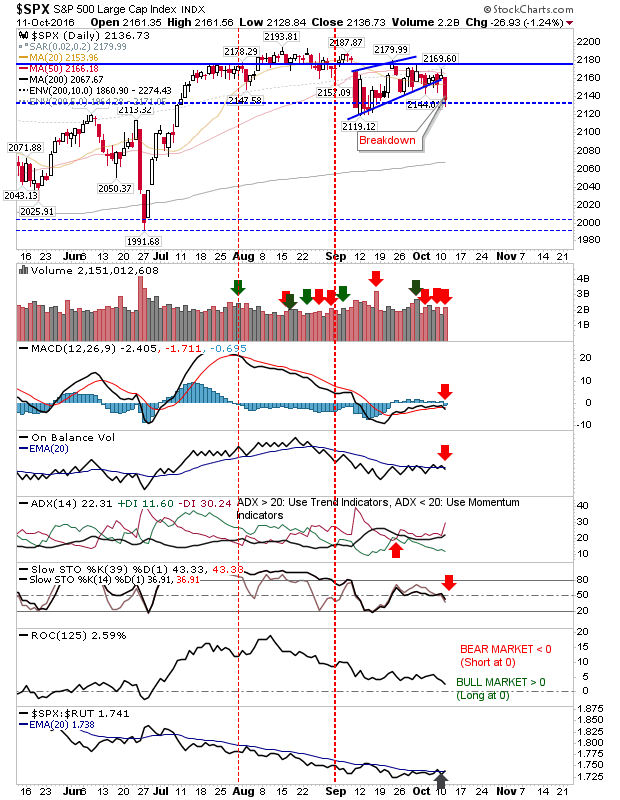

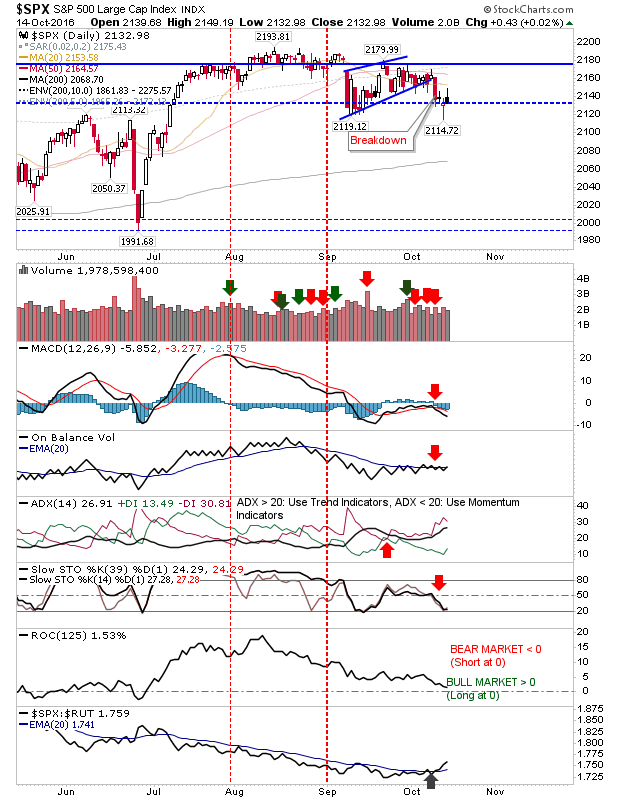

Late Selling Leaves Markets at a Crossroads.

The follow through from Thursday's buying burned out after the first hour of Friday's trading and Friday closed back at Thursday's close. Where Thursday's action had set up for upside follow through, Friday's 'inverse hammer' is offering the reverse. The question is how strong the respective buying and selling which created the spikes from Thursday and Friday are? Monday is likely to start with a test of Thursday's buying. What happens after the first half hour of trading will set the tone for the rest of the day. The S&P is trading below 20-day and 50-day MAs. Thursday's selling was greater than Friday's buying which is another tick in the bear column. Technicals are all negative. The only positive was the relative out performance of the index to the Russell 2000.