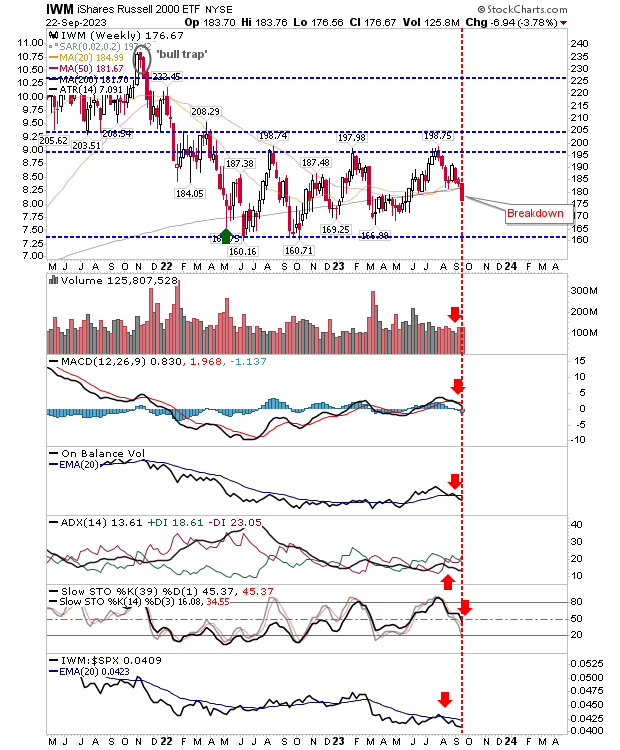

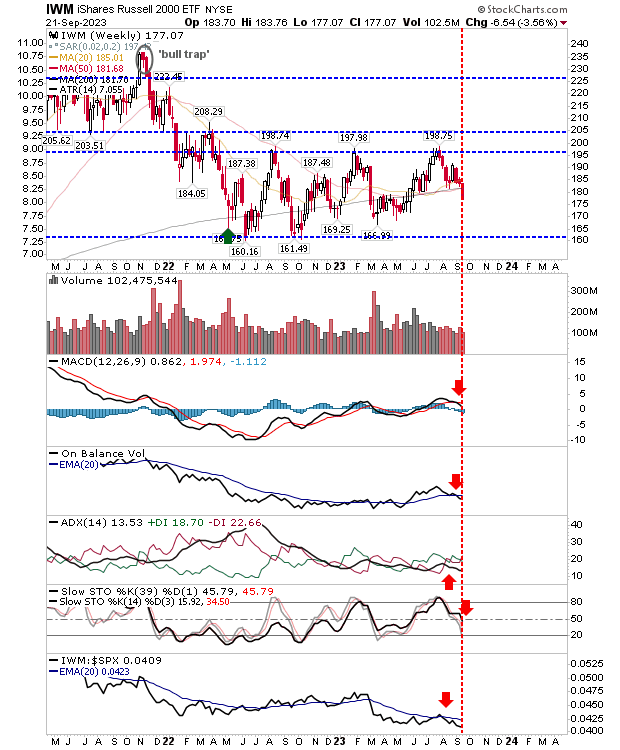

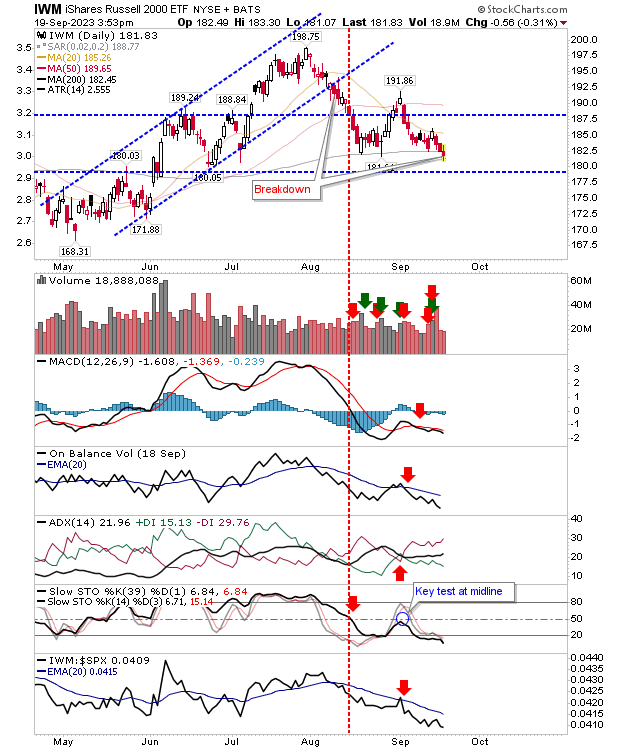

Yesterday's buying quickly undone by today's selling distribution

It was a slam dunk day for bears as whatever support, such as the retention of 4,325 in the S&P, was sliced apart. We are now looking at measured move targets for the Russell 2000 ($IWM), S&P, and Nasdaq, and tests of their respective 200-day MAs. The S&P is on course to reach its measured move target, with a good chance for a follow through to its 200-day MA. Technicals are net negative, but the index is still outperforming peer indices.