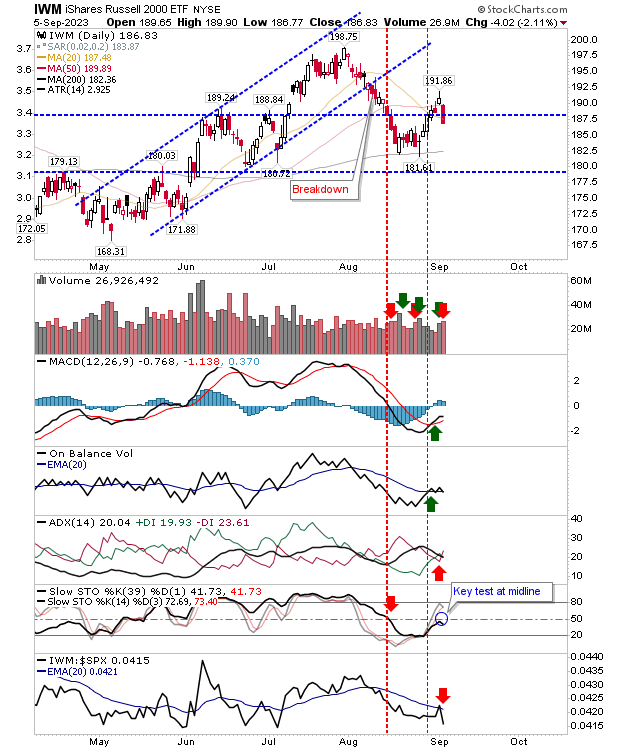

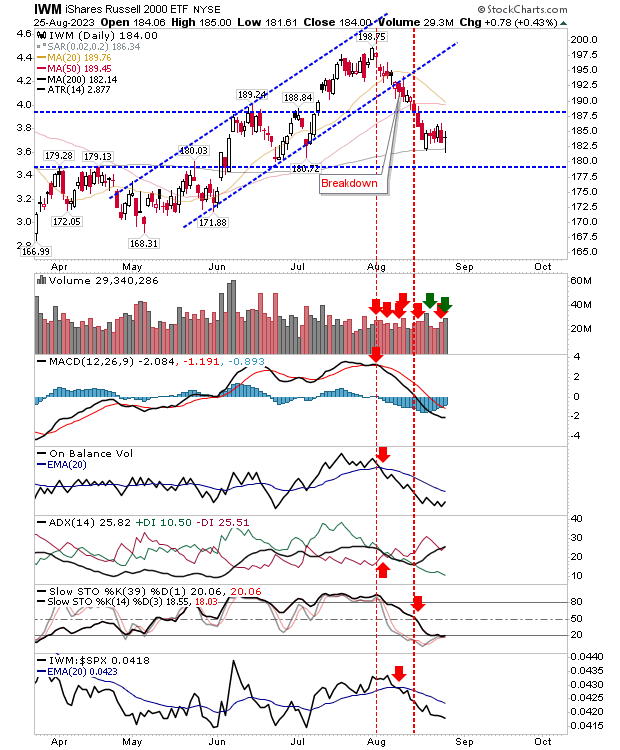

The S&P and Nasdaq are rebuffed at 50-day MAs, but Russell ($IWM) has potential

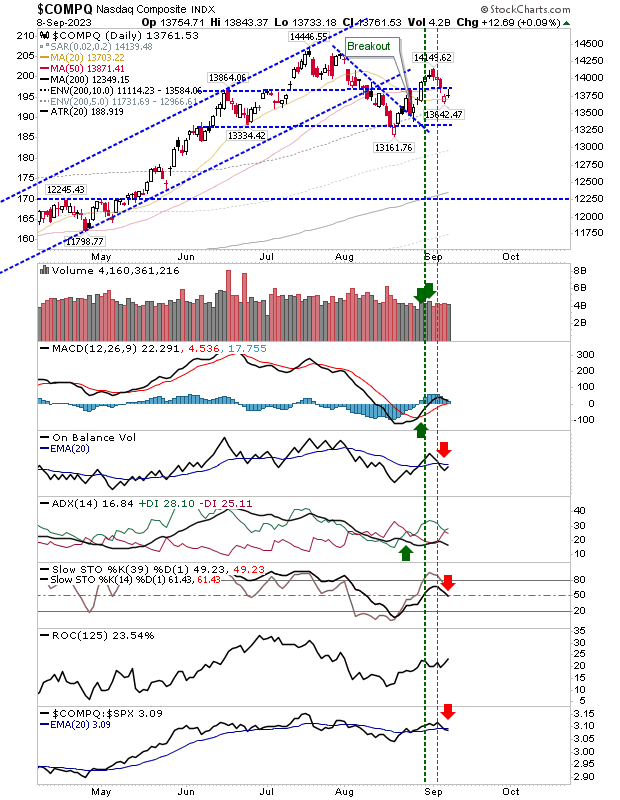

Friday's brief recovery for the S&P and Nasdaq quickly found itself running into trouble at their respective 50-day MAs. It was a little different for the Nasdaq in that it started the day at its 50-day MA, but the early rally stalled out after it closed the Thursday gap down. The Nasdaq experienced a new 'sell' trigger in slow stochastics and an underperformance relative to the S&P, joining the earlier 'sell' trigger in On-Balance-Volume. Given that, I would be looking for some weakness early next week, but a close above Friday's doji high would negate the weakness of that candlestick.