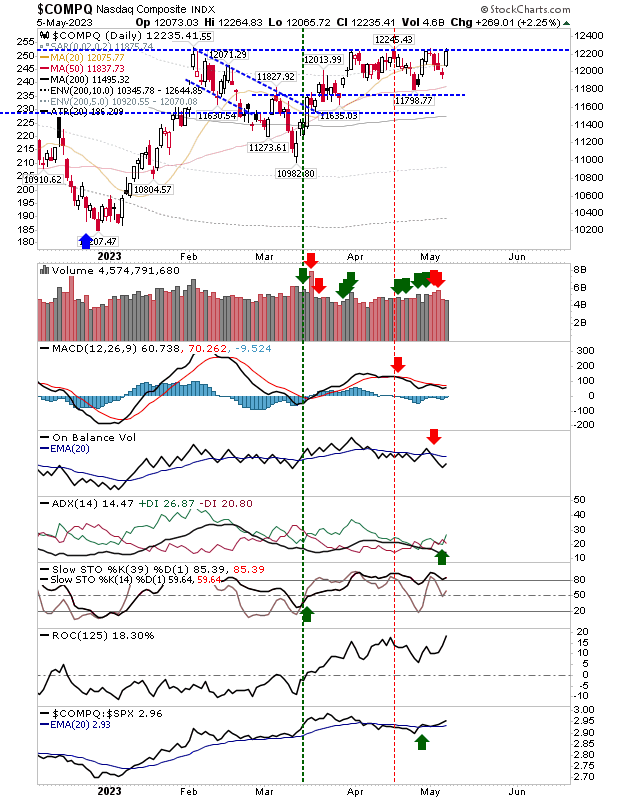

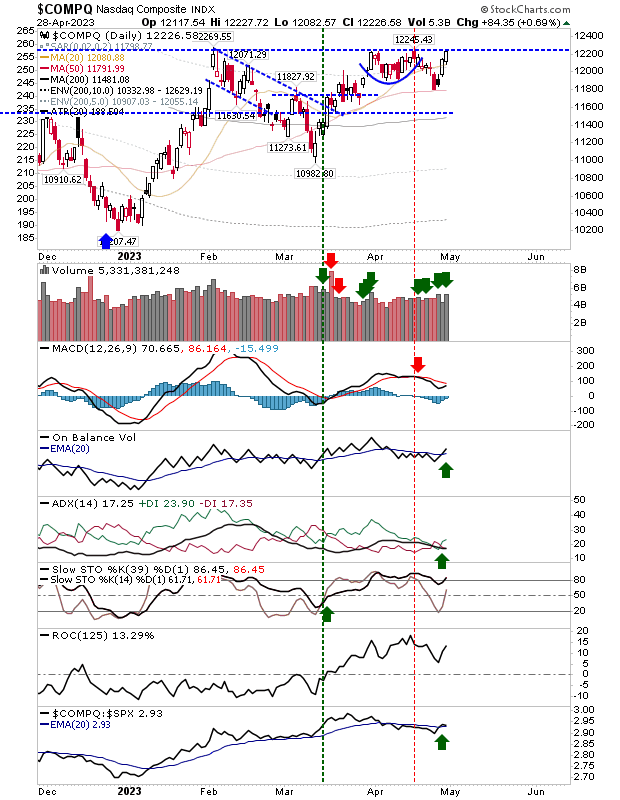

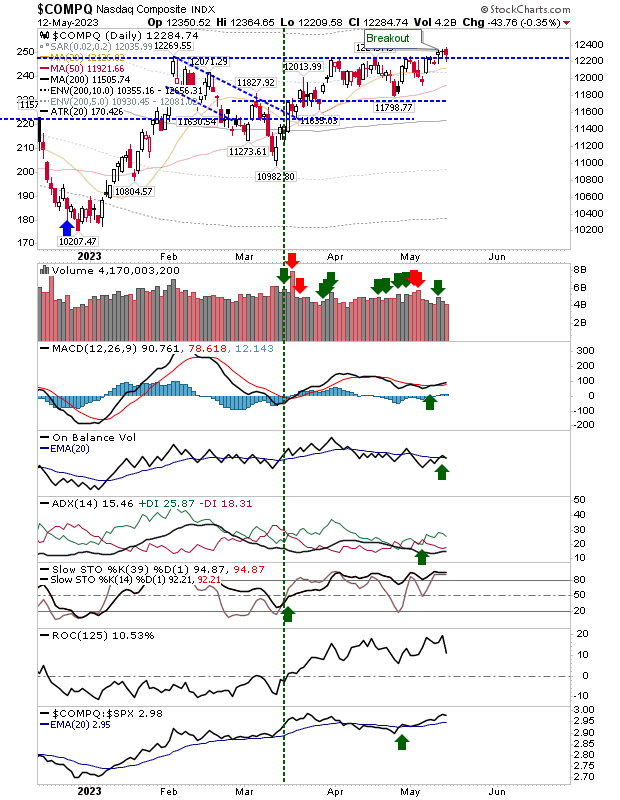

Nasdaq breakout holds into the weekend, but follow through needed.

The Nasdaq went into the weekend with a breakout, and despite Friday losses it managed to cling on to breakout support. There was good buying volume on the breakout, and Friday's selling volume was well down on previous buying - confirming the move. The let down was the lack of price follow through. Technicals are in good shape, particularly stochastics amd relative index performance. The only disappointment was the relatively lacklustre MACD, which has flatlined a little.