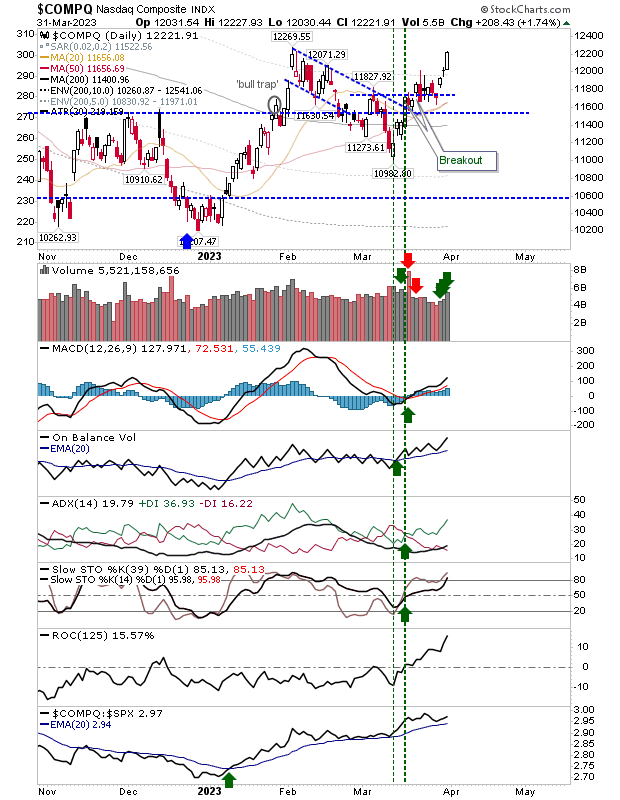

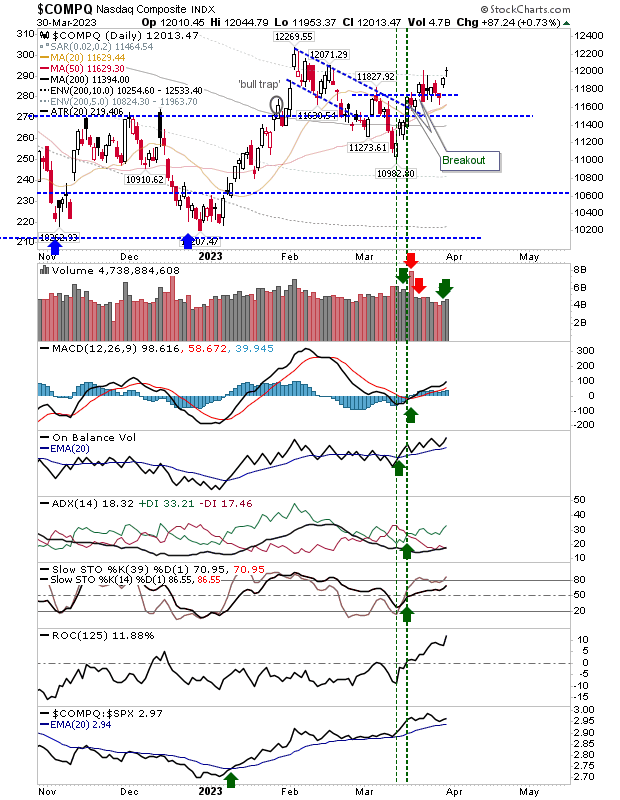

Nasdaq primed for breakout

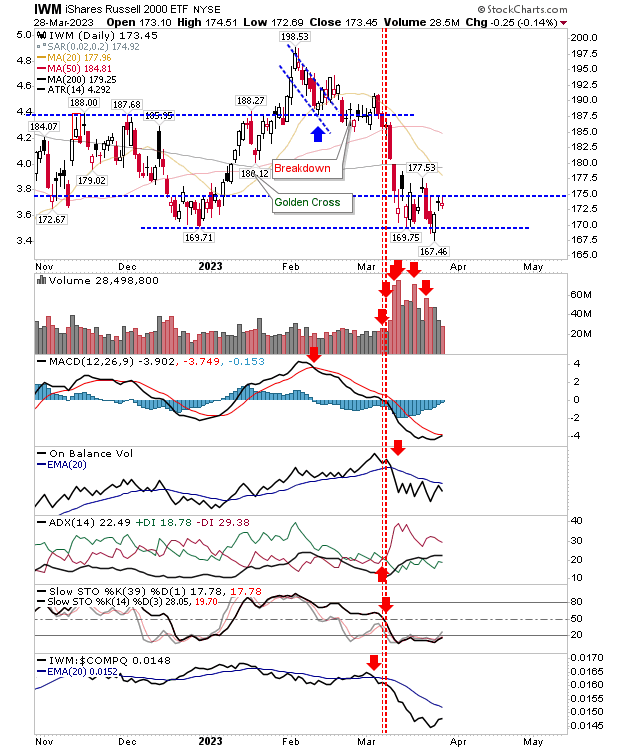

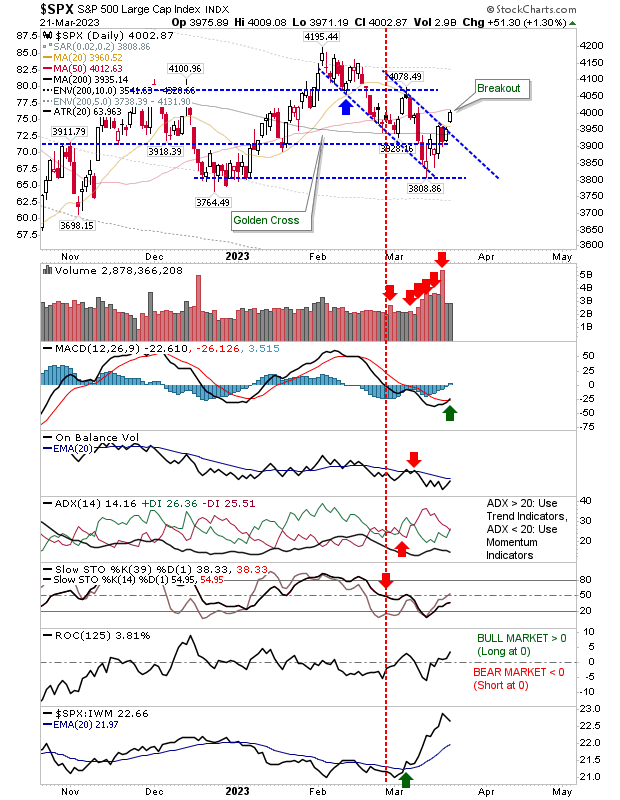

Markets experienced modest losses, but there is still underlying strength in the market. The Nasdaq is primed to break to a new swing high, helped by the relatively light volume associated with today's selling as it knocks on the door for a close above 12,200. Technicals remain net bullish, although the index did lose some relative performance against the S&P. However, Rate Of Change is the highest it has been for months, another indication of bullish strength and the likelihood of a breakout in the coming days.