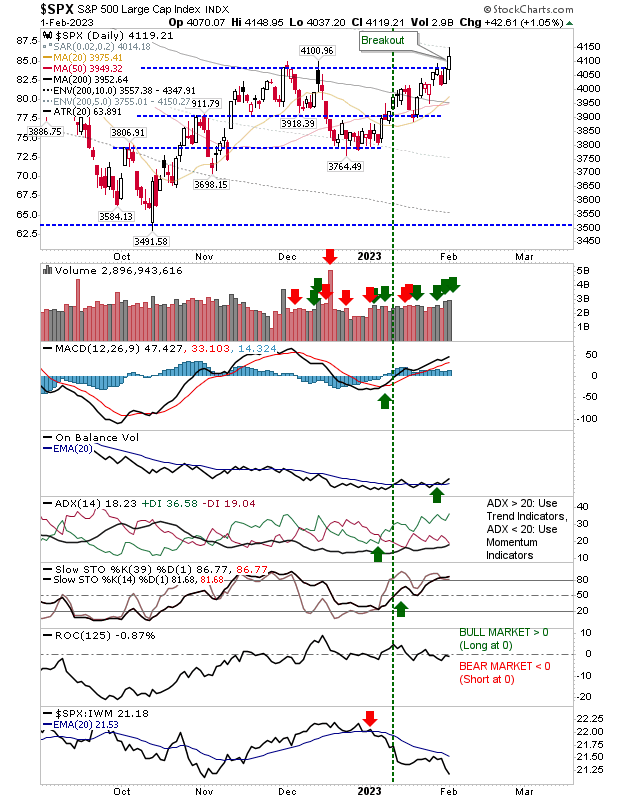

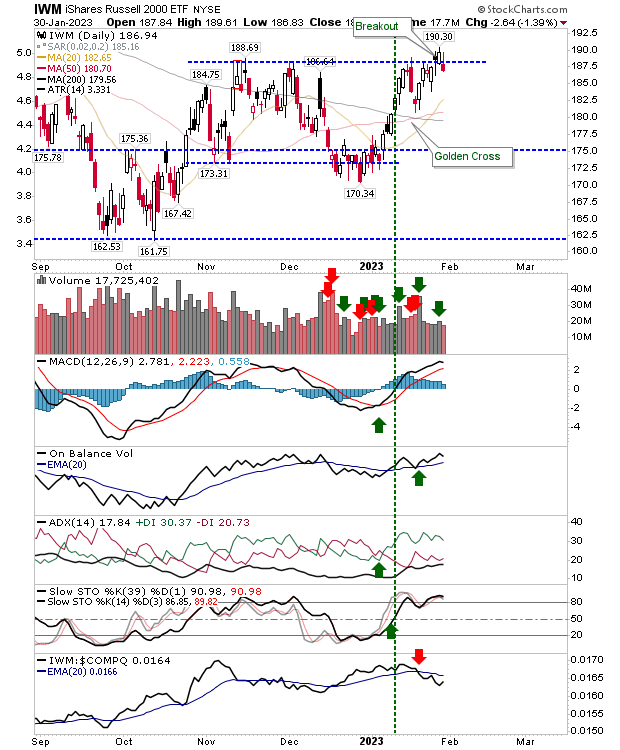

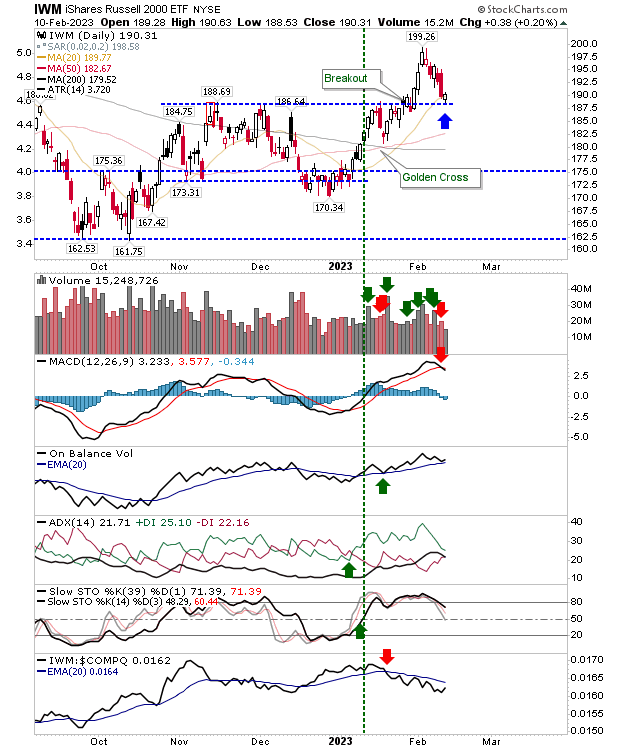

Russell 2000 and S&P successfully test breakout support

A good end-of-week finish for markets offered positive tests of support to head into next week with. The Russell 2000 tagged breakout support defined by November's swing high and 20-day MA. Volume steadily declined off the reversal from the $199 high - another positive - although the MCD trigger 'sell' was a little disappointing.