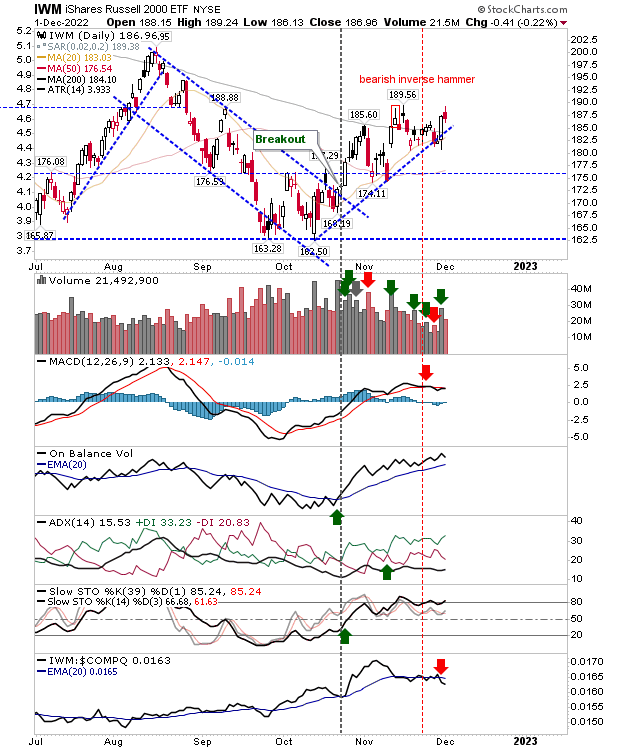

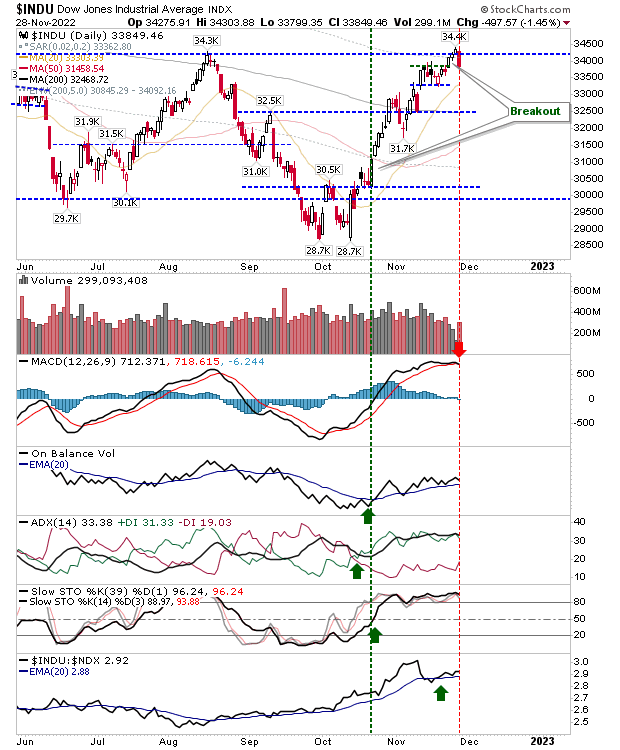

A weak start to the week, but this is not important

We don't want to dwell too much on today's action, although at the same time, we don't want the selling to get away from us. Sellers were able to push markets lower on light volume. The Nasdaq drifted back to support, but was able to hold the prior support level (at least, support before the 'black' candlestick appeared). There was a 'sell' trigger in On-Balance-Volume but there is a large degree of whipsaw in this indicator since the swing low in November. There is a modest uptick in relative outperformance against the S&P which may help the index build out from its November bottom, but this nascent trend needs to continue.