Bulls fluff their lines into the Labor weekend

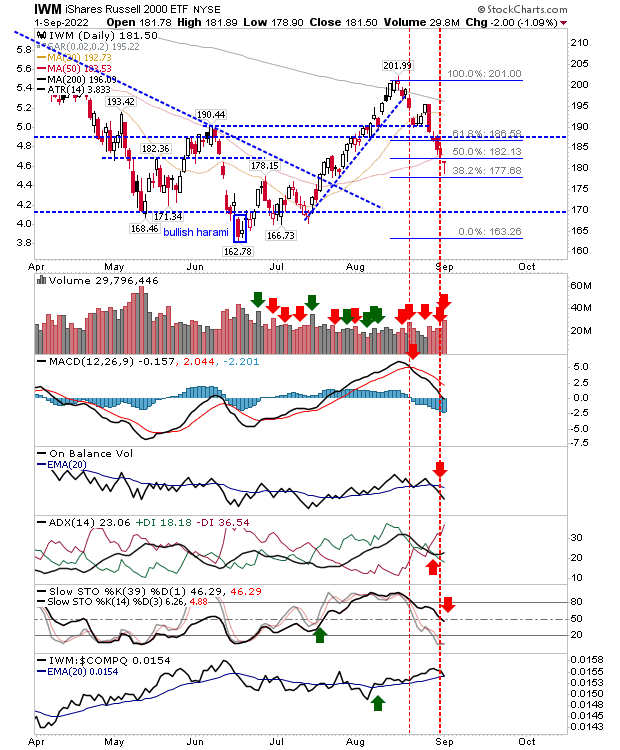

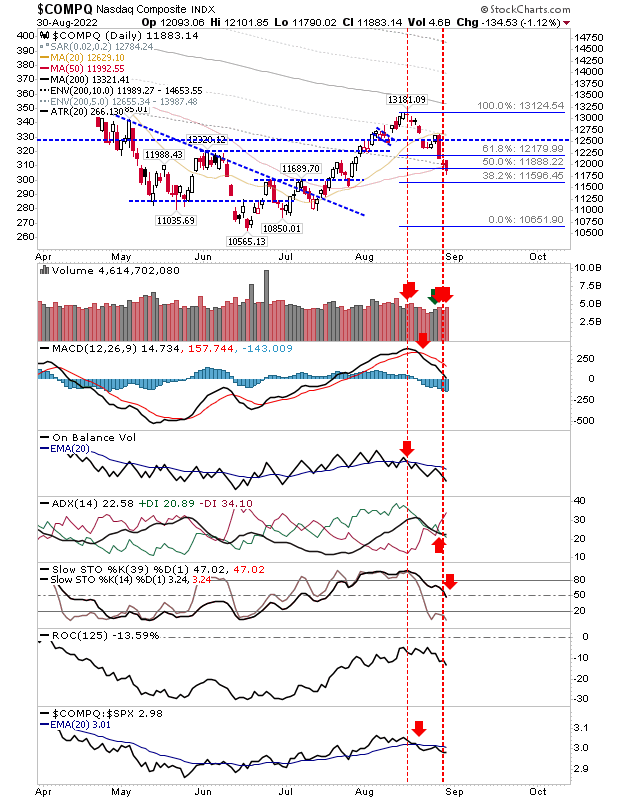

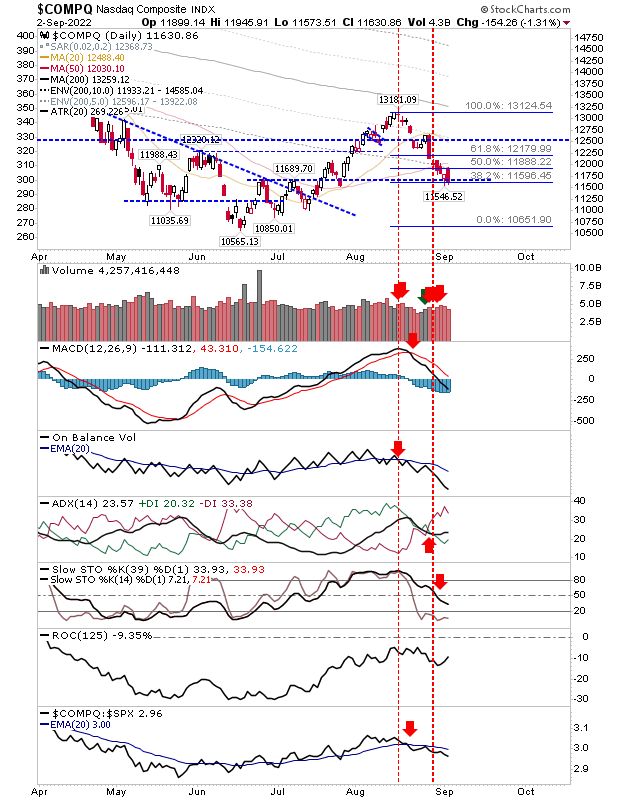

It was a classic technical bull trade but somehow bulls contrived to make a mess of it. It's not all lost, but the gap higher which quickly reversed and weakened throughout the day doesn't leave much room for maneuver. For the Nasdaq and S&P there were bearish engulfing patterns of Thursday's bullish hammers. Thursday's doji in the Russell 2000 was similarly engulfed by Friday's selling. The net result is to expect further losses when traders return to their desk on Tuesday. Stochastics for the Nasdaq haven't yet reached an oversold level which is a little troublesome given the extent of losses leading into Friday's losses. The opportunity for the momentum rally at the stochastic mid-line is now off the table - so now we have to look at the possibility for a bottom when stochastics do finally reach an oversold state.