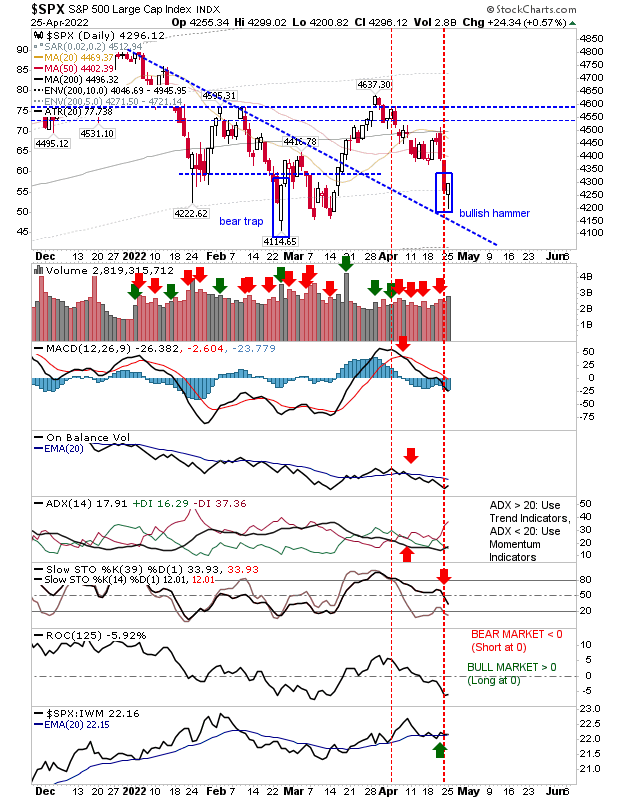

Despite the buying, breakdowns remain

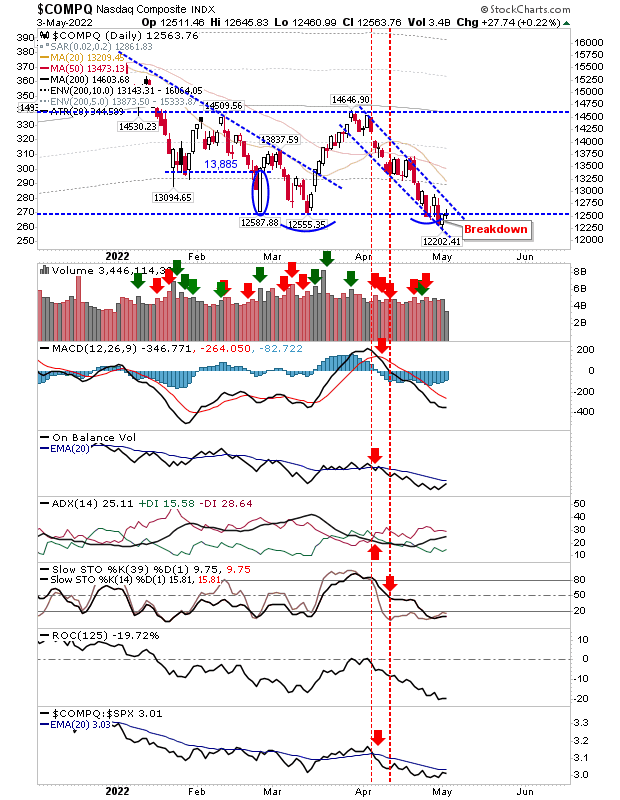

Last week closed with sellers in control and this pessimism was reflected in the buying of the last two days. The Nasdaq had undercut March lows and had managed a day of accumulated buying yesterday, but today's neutral doji marked doubts on behalf of buyers. Technicals are net bearish, but there is a slowly improving relative performance for the index which may be reflected in the Nasdaq over the coming days.