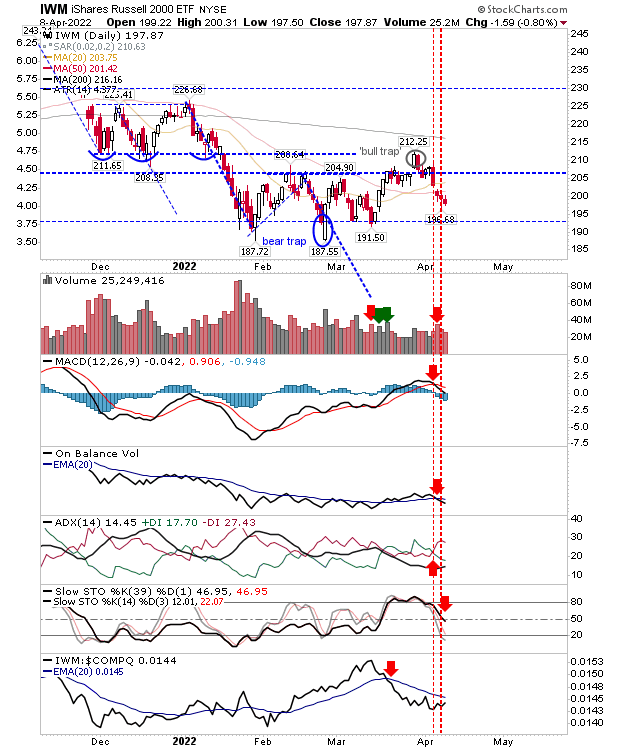

Sellers accelerate move back to February/March Lows

A relatively torrid Thursday and Friday saw markets push towards the lows of February/March after failed attempts to shape a higher low. Should we undercut these lows then we will have to consider the possibility for a larger measured move lower (anchored from the March high). If were were to consider the Nasdaq as a starting point, then the measured move down would give an approximate target of 10,900 or the swing low of August 2020 (at 10,520). There isn't a whole lot on the technical side which is positive and the fact intermediate stochastics [39,1] are not oversold suggests there is more downside to come.