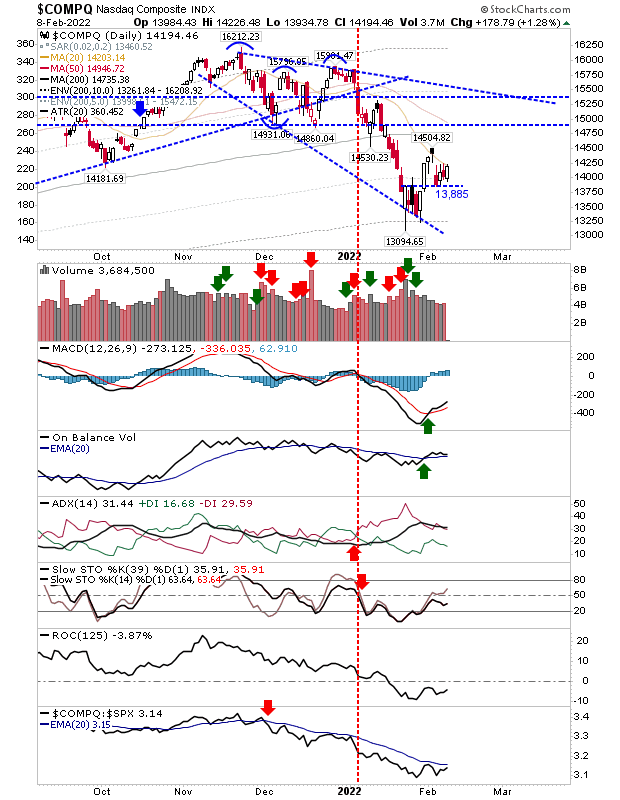

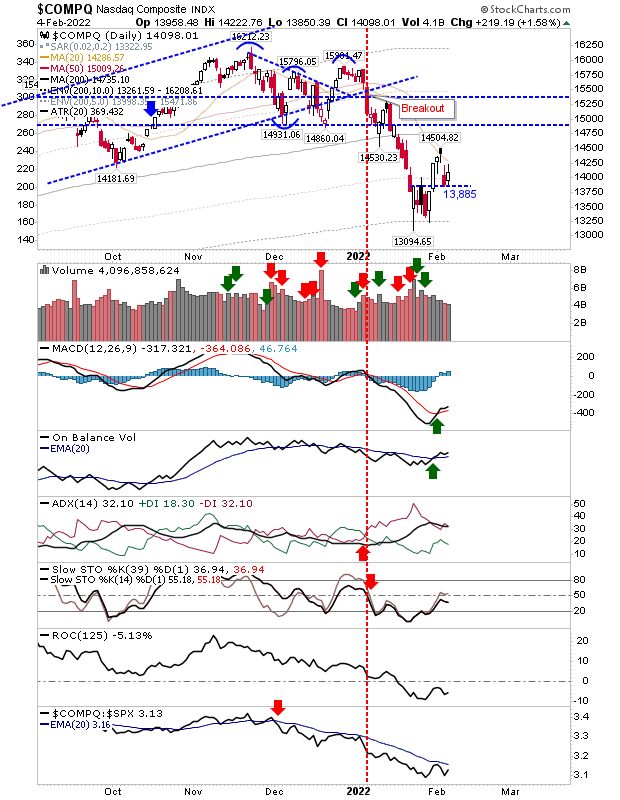

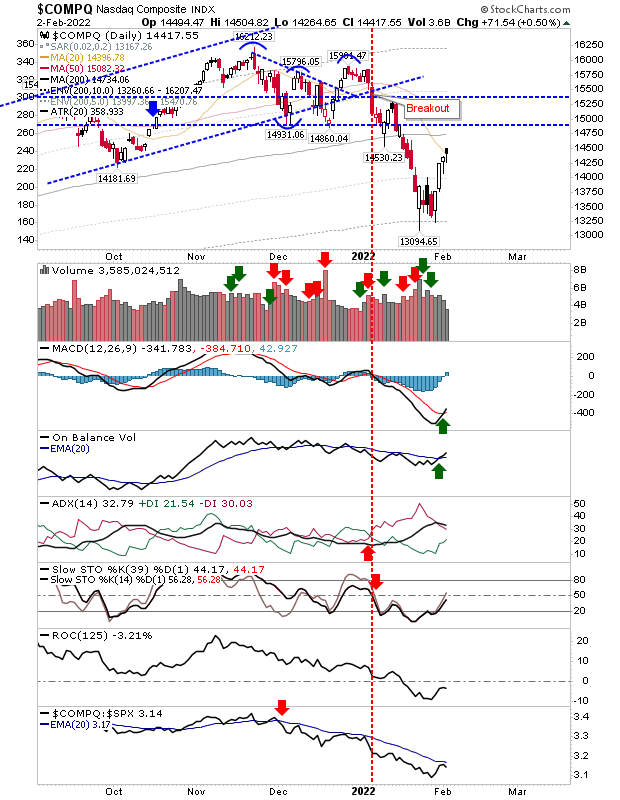

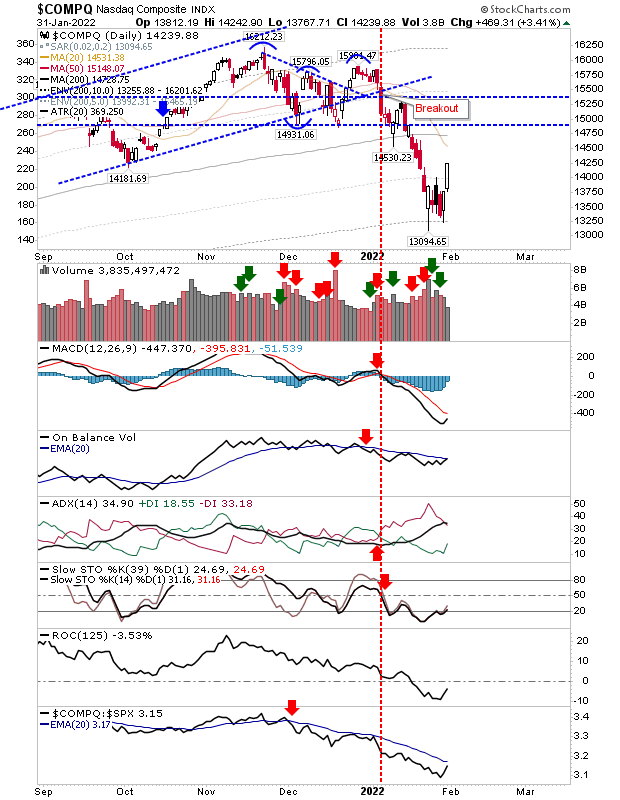

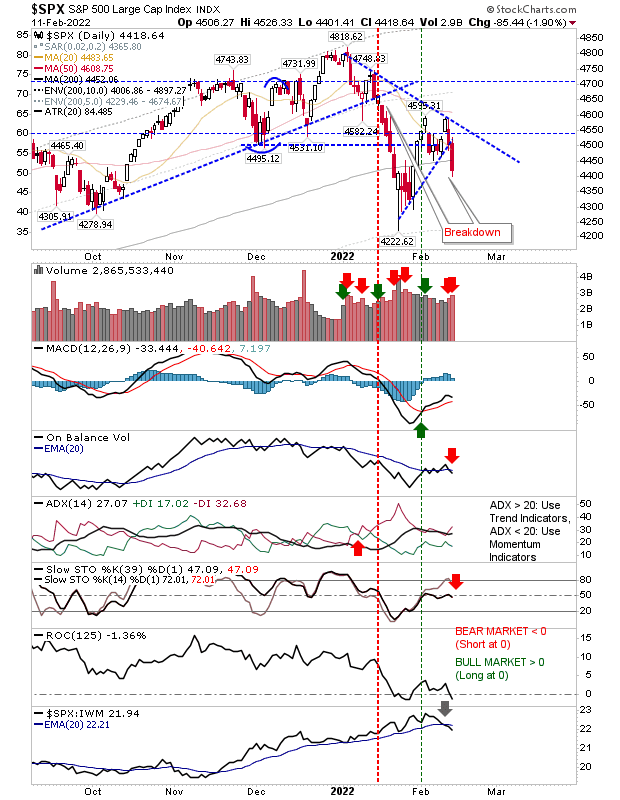

The bounce tails off as sellers re-emerge

The bounce off January swing lows tapped out Friday as traders were keen to take profits on higher volume distribution. In the case of the S&P there was a confirmed 'sell' trigger in relative performance over the Russell 2000 along with an On-Balance-Volume 'sell' trigger. Friday also delivered a trendline break and an undercut of the 200-day MA for a second time in less than a month. Intermediate term stochastics were also rebuffed at the mid-line, another sign we are in a bearish market. We are probably looking at a measured move lower to around 4,000; it would take a break of 4,600 to negate this target.