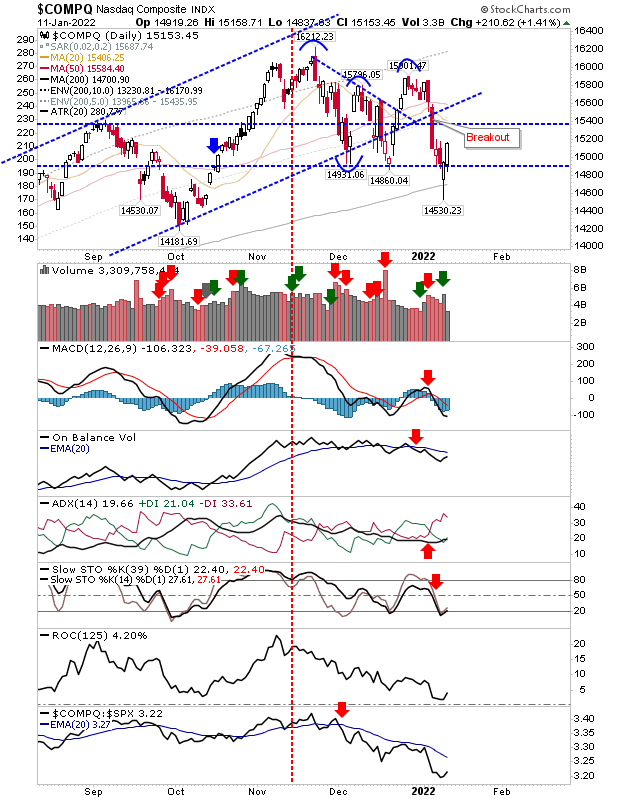

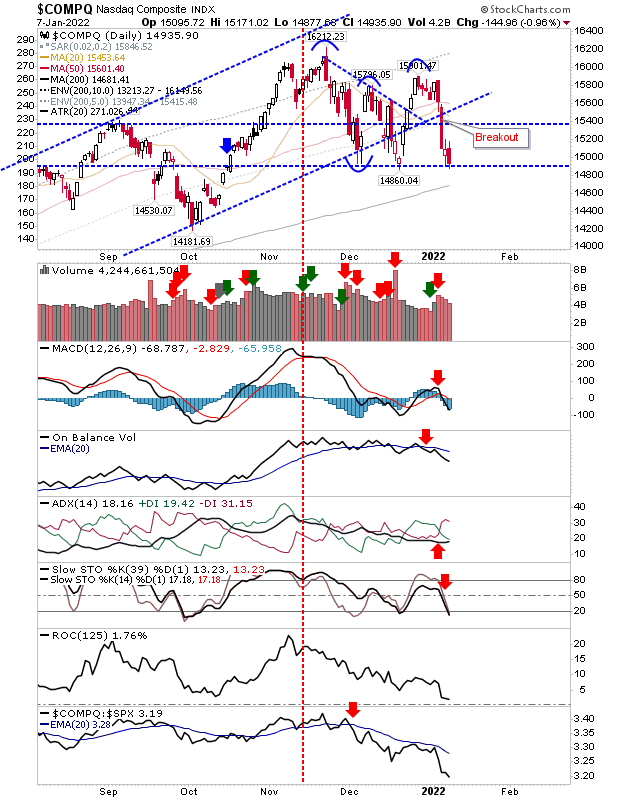

Markets saw panic buying yesterday, but today is the hangover...

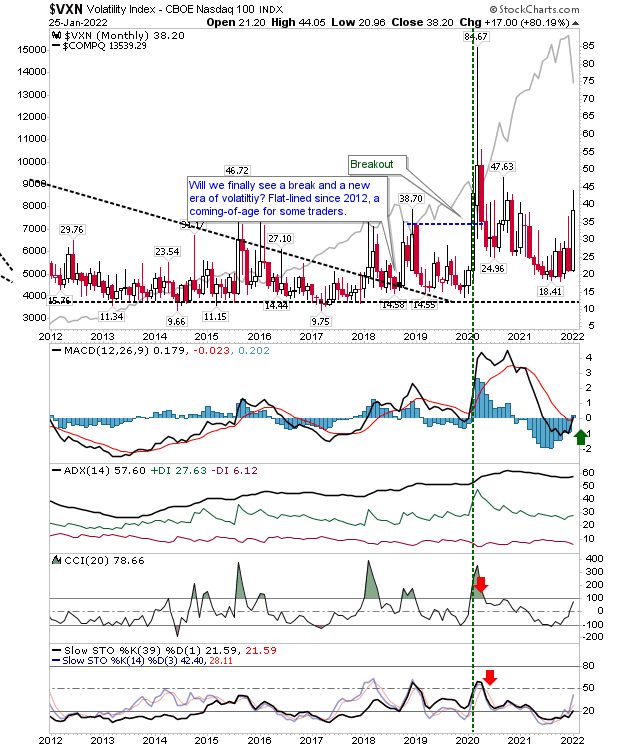

For those with a long hold time frame, buying here is not to bad a thing to be doing. Those Tik Tok traders looking to steal a profitable trade are unlikely to fare too well as whipsaw becomes a real issue based on the sharp uptick in volatility. The Nasdaq 100 had a enjoyed a sustained period of low volatility for most of the 2010s, but since breaking from this period of (volatility) consolidation in 2018 it has been steadily rising. Luckily, markets had enjoyed a sustained period of gain despite Covid, but as the virus enters the latter stage of its infectious cycle the 'sell the news' has made an early start, and this creates the volatiltiy we are seeing now.